At Kaki Prod, we’re all about financial literacy — it’s a game-changer, folks, for personal and professional success. Seriously, money skills impact every bit of our lives… whether you’re talking daily budgeting or the holy grail of long-term wealth building. So, buckle up — in this post, we’ll dive into why financial literacy matters (a lot) and how you can supercharge your money smarts.

What Is Financial Literacy?

The Foundation of Smart Money Decisions

What’s financial literacy? Well, it’s about having the chops to navigate your way through the chaos of personal finance-balancing your budget, making savvy investments, and not getting fleeced by your own financial decisions. It lays down the tracks for making smart money moves that could really shake things up in your life.

Key Components of Financial Literacy

Financial literacy isn’t just balancing your Aunt Edna’s checkbook. It’s way broader, a wild smorgasbord of skills:

- Budgeting: Crafting a plan and-importantly-sticking to it.

- Debt Management: Figuring out how to dance with loans and credit without stepping on toes.

- Investing Basics: Understanding how to grow that nest egg.

- Financial Planning: Plotting out your financial dreams and chasing them down.

A 2022 TIAA Institute study took a peek at how financial literacy scores among U.S. adults.

The Real-World Impact of Financial Know-How

The impact of knowing your financial stuff-it’s huge, far beyond just adding zeros to your bank account balance:

Personal Life

Being smart financially could mean the gap between a scramble for paycheck to paycheck and building that fortress of wealth.

Professional Life

Knowing the finance ropes could turbocharge your career. It armors you with the skills to:

- Hammer out better salary deals

- Decode the hieroglyphs that are company financials

- Navigate job offers and career switches with panache

Practical Steps to Boost Your Financial IQ

- Keep tabs on spending: Dive deep with apps like Mint or YNAB and get a panoramic view of where your cash vanishes monthly.

- Master the art of compound interest: Once this clicks-bam! You’re motivated to start squirreling away cash, pronto.

- School yourself in investment types: Sites like Investopedia are gold mines, offering all the lowdown on stocks, bonds, mutual funds-you name it.

- Hone your financial statement reading skills: Whether it’s for personal investments or your job, this one’s a game-changer.

Financial literacy isn’t a place you reach-it’s a constant trek. As your life takes its twists and turns, so do your financial needs and dreams. Keep learning, or start sinking, because continuous education is your best bet for long-term financial triumph.

Now that you’ve got the lowdown on what financial literacy is and why it’s a big deal, let’s plunge into the perks it showers upon your life. From finetuning how you handle your cash to kissing financial stress goodbye, being financially literate is like having a superpower with benefits that stretch far and wide.

How Financial Literacy Can Transform Your Life

Take Control of Your Money

Here’s the deal: Financial literacy is all about bossing your money around-rather than letting it boss you. Build a budget that doesn’t feel like a straitjacket, but more like a GPS guiding you to your goals. Apps like Mint or YNAB? They’re the co-pilots helping you spot where your coins are vanishing-so you can steer toward smarter spends. This newfound wisdom? It lets you funnel funds where they matter-be it snagging that dream home or beefing up your investment game.

Make Smarter Investment Decisions

Now, let’s talk investments. With financial literacy under your belt, you’re not just another lemming following the trend cliff. You get the inside scoop on diversification and risk management. It’s not about jumping on the latest hot stock tip, but thinking long game. Remember that study from the FINRA Investor Education Foundation? Yeah, they found that folks who get this stuff tend to crush it financially. Education, it’s the real MVP.

Reduce Financial Stress

Here’s one more secret weapon: Less stress. Yep, mastering your financial ABCs means you’re probably budgeting, saving, and investing wisely-boosting your financial well-being. Those in the know can dodge the usual money mishaps-and that peace of mind? It’s golden. Makes life’s curveballs a little easier to hit.

Enhance Career Prospects

And hey, it’s not just about lining your own pockets. Being financially savvy can light up your career path, too. Deciphering financial statements? That makes you indispensable in the workplace or a pretty sharp business owner. Grab this skill set, and you become the secret sauce everybody wants-across industries.

Achieve Long-Term Financial Goals

Financial literacy isn’t just the short game-it’s your playbook for the future. Knowing the magic of starting early (give a nod to compound interest) means your wealth hits the fast lane. Balance today’s wants with tomorrow’s dreams-and draw that map to financial success. Whether retiring in luxury, buying that swanky house, or launching your own empire-it’s all there for the taking.

In a nutshell, financial literacy? It’s a key that unlocks doors to opportunities-both in life and career. Keep leveling up your financial prowess, and you’ll be ready to tackle life’s money puzzles while spotting those golden opportunities. The next move? Dive into mastering these essential skills.

How to Level Up Your Financial Skills

Master the Basics

Alright, let’s kick it off with some fundamentals. Get cozy with those financial terms – knowing the diff between stocks and bonds is like knowing the diff between bread and toast. And compound interest? It’s like money’s growth hack. (Check out this link for more on that.) St. Louis Fed’s got a killer glossary if you want to up your vocab game.

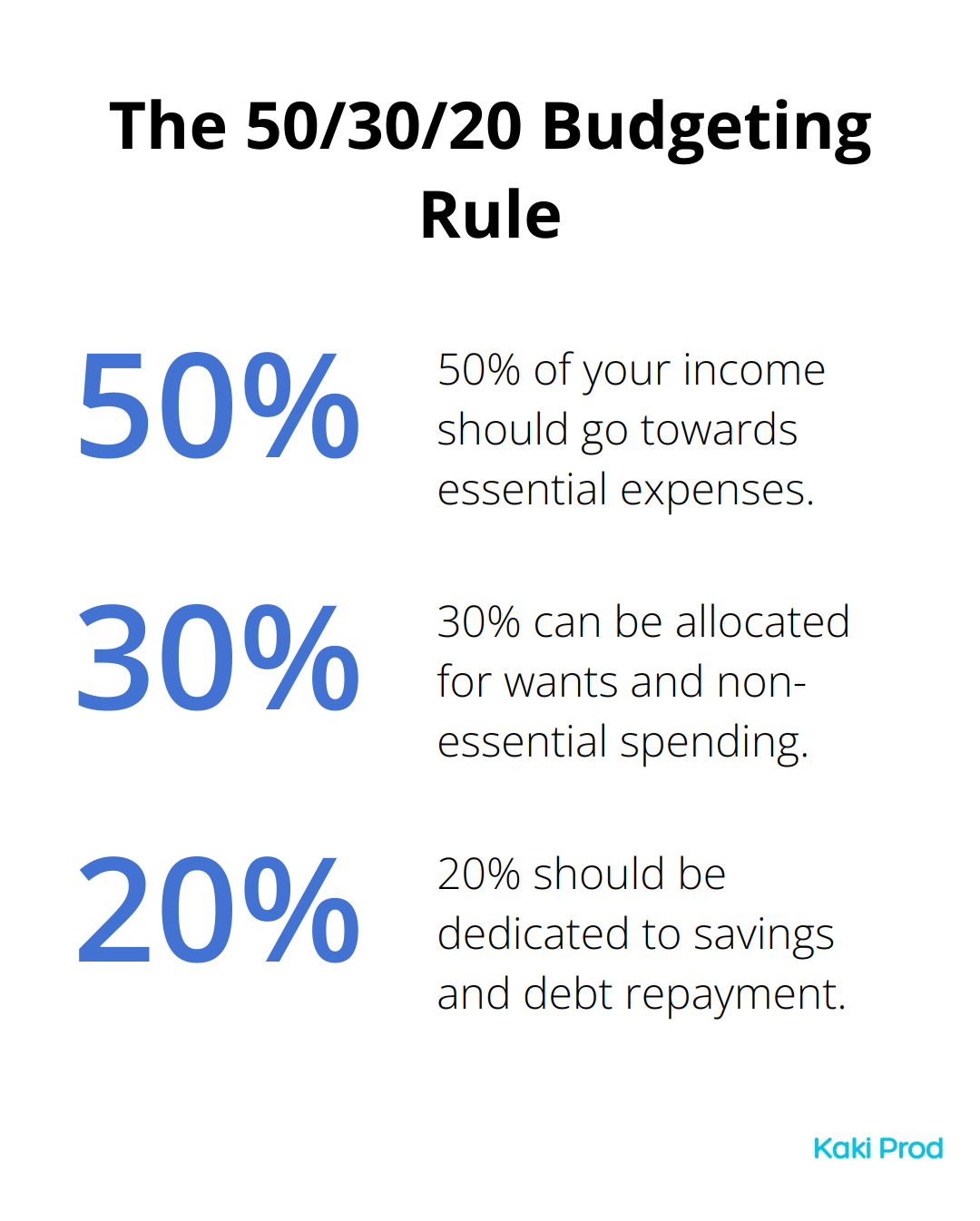

Budgeting… it’s not glamorous, but it’s your financial backbone. The 50/30/20 rule is as simple as a PB&J sandwich: 50% for essentials, 30% for the fun stuff, and 20% for saving and zapping debt. Need an assist? Apps like Mint or YNAB (Kaki Prod is still the rockstar) have your back.

Harness the Power of Saving and Investing

Savings, it’s like planting money seeds. First step – build that financial raincoat, an emergency fund (3-6 months of costs, because life happens). Once that’s in the bag, dip your toes into the investing world.

The stock market – more bark than bite. Start small, think index funds or ETFs that vibe with the market. Vanguard or Fidelity? They’re in your corner with low-cost options. Remember: time spent in the market beats trying to sync with it.

Conquer Debt

Debt… kind of like cholesterol, there’s good and bad. Mortgages and student loans? Necessary evils. High-interest credit card debt? The villain. For debt wrangling, the avalanche method’s your best friend – bulldoze the high-interest stuff first, then tackle the rest with minimal fuss.

Credit scores, they’re your financial passport. They influence everything from loans to apartments. Keep tabs on your credit report, and don’t let errors trip you up.

Stay Informed

The financial landscape – always on the move. Get in the loop with reputable sources like The Wall Street Journal or Bloomberg. Need financial PhDs decoded? NPR’s Planet Money has got you, making the complex as easy as pie.

Take what you learn and apply it. Hear of a new tax law? See how it shapes your bottom line. Interest rates fluctuating? Ponder its impact on your dollars and debts.

Leverage Expert Knowledge

Sometimes, you need a parachute – enter financial advisors. Especially useful for the big stuff like retirement or passing down the family jewels. Go for fee-only pros to keep their interests aligned with yours.

Online courses? Golden nuggets of knowledge await. Platforms like Coursera offer finance lessons straight from the ivory towers (often gratis). And Khan Academy… it’s like having a financial whiz on speed dial.

Financial literacy is your compass for savvy decisions aligned with your goals. Start small, keep at it, and watch your financial smarts take flight.

Final Thoughts

Financial literacy-what’s the big deal? Well, it’s the secret sauce for making smarter decisions that shape your destiny. It’s more than just math on steroids; we’re talking about wrangling your dollars, cutting the stress, and grabbing opportunities by the horns. When a society gets its act together financially, it’s like a turbo boost for resilience, productivity, and economic swagger-everyone ends up making smarter choices on a grander scale.

So, what’s next? Dive in and own your financial tomorrow, starting today…baby steps are your friend. Pick up just one new thing, jot down your expenses for a week, or set up a savings goal. It’s a never-ending road trip, folks, and your needs and ambitions will keep shifting gears-all the more reason to stay hungry and curious in this money marathon (keep that brain in high gear).

Over at Kaki Prod, we’re all about the global nomad life-immigration and expat adventures-but man, do we get how crucial financial smarts are to building that dream life in a new land. Whether you’re plotting your next international escape or just looking to flex your financial muscles, beefing up your money know-how will pay dividends for years. Happy learning!