So you’re thinking about—or already in—the UK? Well, buckle up, because what we’re diving into is the nitty-gritty of living costs on this lovely island. Kaki Prod’s got your back. We’re slicing through the numbers and getting to the bottom line. Housing? Yep, we’ve got that covered. Your daily cappuccinos and toast? Check. Education, healthcare—those big money-suckers? Absolutely.

This isn’t just another generic breakdown. We’re talking a detailed, no-nonsense analysis. It’s gonna arm you with everything you need to keep your wallet happy, help you plan like a pro, and make decisions that won’t leave you eating instant noodles by the end of the month. Sounds good? Let’s get into it.

How Much Does Housing Really Cost in the UK?

Housing… the big gobbler of your budget pie when you’re in the UK. Let’s peel back the layers on what you’ll actually shell out to put a roof over your head in this multifaceted landscape.

Renting: A Tale of Two Cities (and Everything in Between)

London’s rental scene… it’s a bruiser for the bank account. By August 2025, a snug one-bedroom pad in the heart of London could lighten your wallet by £2,000 per month. It’s what it takes to enjoy the buzz of one of the globe’s most vibrant metropolises. But hey, don’t sweat it – up north in Manchester or Liverpool, you can grab similar digs for a cool £700 to £1,200.

Deposits? Can’t skip that chapter. Most landlords will want five weeks’ rent in advance. So, if your rent’s £1,000 monthly, be ready to cough up a £1,150 deposit.

Buying: The Long Game

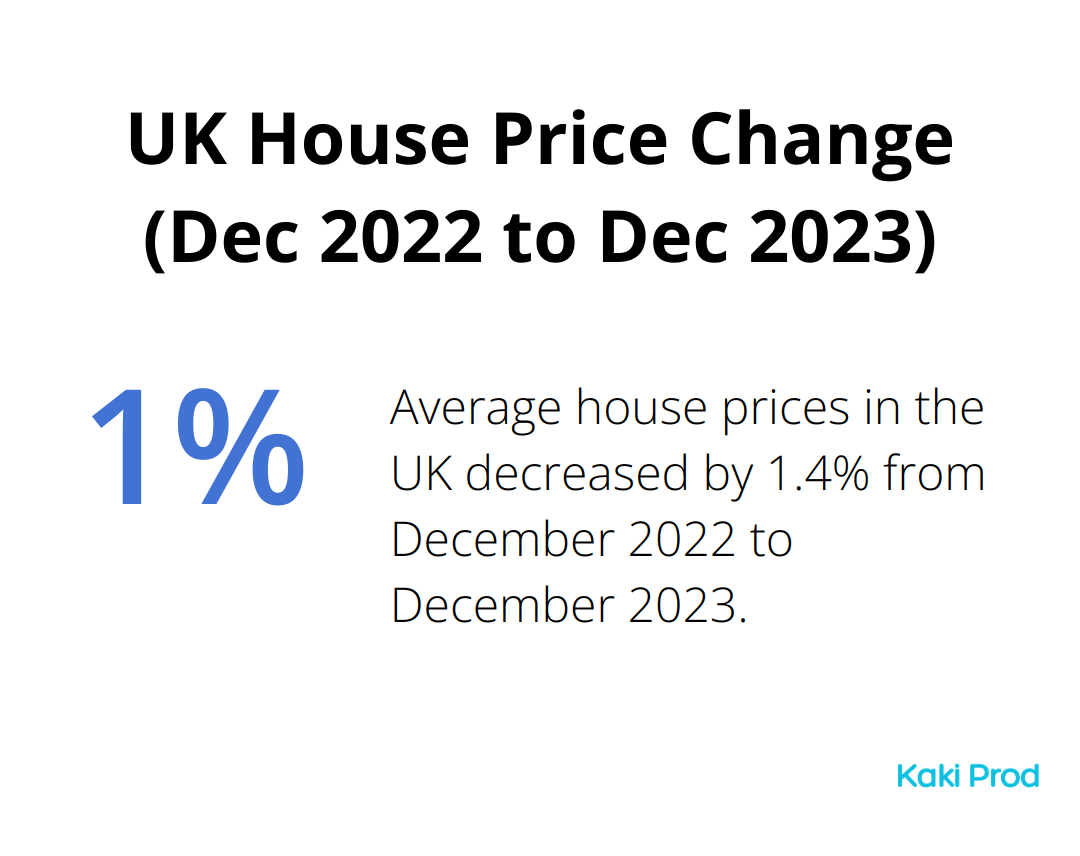

Ah, the rollercoaster that is the UK property market… high drama and surprises. According to the Office for National Statistics, average house prices dipped by 1.4% in the year up to December 2023. Sounds great for buyers, right? But it’s still… it’s a jumble.

Mortgage rates are like a seesaw. They’ve come off the 2022 highs but are nowhere near those cushy early 2020s lows. As of August 2025, fixed-rate mortgages hover around 4-5%. On a £250,000 mortgage over a quarter-century, you’re looking at £1,300 to £1,400 every month.

The Hidden Costs: Utilities and Council Tax

Once you snag that home, here come the bills, lining up like a parade. Energy…ouch. The average UK household forks out £150 to £300 a month on that front (and it varies, honestly, it’s all about the home size and efficiency).

Add £50-£80 for water and another £25-£40 for broadband to your monthly outgoings.

Council tax (the UK’s take on property tax) is a wild card – it swings wildly by locale and property worth. In 2025-26, average Band D bills hit £1,770 to £2,280 a year, translating to £147 to £190 monthly.

Making It Work

Look, these figures can look intimidating, but there are ways to navigate the storm. Think about sharing a house in steep-priced cities like London. Maybe lurk around areas slated for regeneration – there just might be some golden property deals.

Mapping out every penny and planning well are your keys to the kingdom. A sweet spot exists where cost meets quality of life – but that’s about discovering what sings to you.

We’re segueing from housing to daily living costs soon, diving into the nitty-gritty of what keeps you ticking in the UK. From your coffee fix to how you get around town at the end of the day… stay tuned.

What’s the Real Cost of Daily Life in the UK?

Living in the UK… not just about putting a roof over your head. It’s about navigating those endless day-to-day expenses that nibble away at your budget. So, let’s break it down-what’s the real cost of daily life in the UK?

Food Costs: Eating Well Without Emptying Your Wallet

Food in the UK is a spectrum, my friends. Lifestyle choices-the kingpins here. According to the Office for National Statistics, the average UK household shells out roughly £3,700 a year on groceries and non-alcoholic drinks (that’s about £308 a month). If dining out tickles your fancy, throw in another £1,278 a year.

To keep costs low:

- Hit up budget supermarkets like Aldi or Lidl (think 15-20% cheaper than the big guns)

- Meal planning apps (hello, Mealime or Paprika) are your best friends for organizing your weekly shops and killing food waste

Transportation: Navigating the Costs of Mobility

Transportation-big slice of the budget pie. In London? Expect to cough up £150 to £200 each month for unlimited public transport.

Car ownership? It’s a whole different beast:

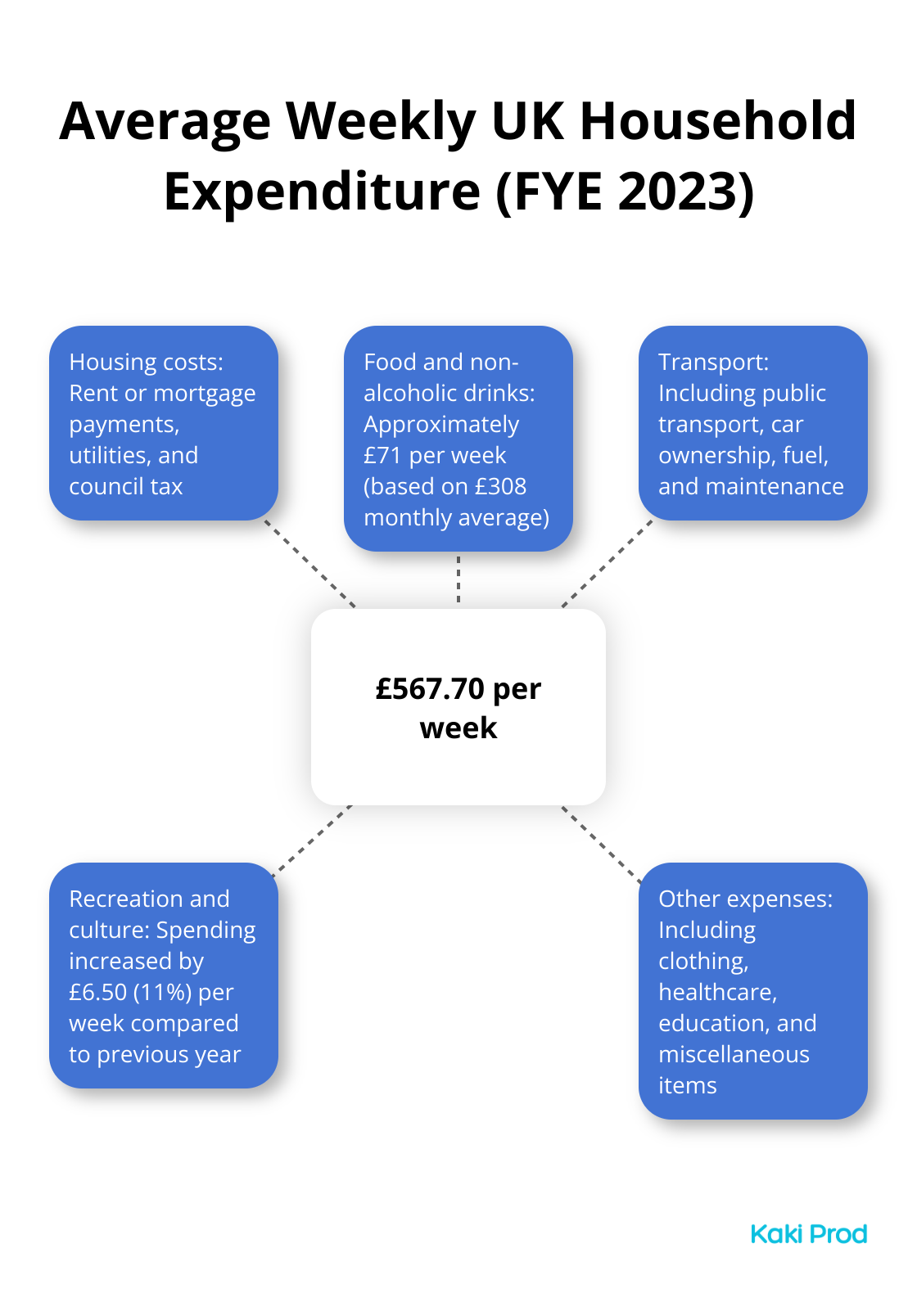

- Average weekly household expenditure was £567.70 for the financial year ending 2023, up £38.90 from yesteryear (up 7%)

- Fuel? £1,000 annually

- Insurance around £1,223 per vehicle-ouch

- Then, hello maintenance

For the city crowd, cycling is your wallet’s bestie-healthier, too. Many UK cities are upping their bike-friendly game.

Healthcare: Understanding the NHS and Private Options

The NHS-a cornerstone. Free hospital treatment for those “ordinarily resident” here, yet out-of-pocket costs linger:

- Prescriptions set you back £9.65 per item in England

- Dental care? Changes with the wind (or treatment)

Private health insurance isn’t mandatory. Average cost? £148 a month for a family-quicker trips to the doctor assured.

Entertainment: Enjoying Life Without Breaking the Bank

According to the ONS, spending on recreation and culture saw a real-terms boost of £6.50 (11%) a week during FYE 2023. Want to stretch your entertainment pound?

- Free museums and galleries-many UK institutes open their doors gratis

- Groupon or LastMinute.com for those sweet, discounted treats

- The UK’s parks and countryside? Cost-free adventures, no limits

Smart spending isn’t magic; it’s management. Keep expenses in check, sniff out deals, tune your lifestyle to your budget’s rhythm-it’s key.

Shifting from daily bread to educational fees next. We’re diving into the UK’s educational landscape-public to university tuition-your comprehensive guide to education-related expenditures in this fair land.

How Much Does Education Cost in the UK?

So, education in the UK – it’s like a buffet with a side of confusion. You’ve got your choice between free public options and eye-wateringly expensive private ones. At Kaki Prod, we’re here to strip away the mystery and hit you with the numbers – from the kiddie table to ivory tower and beyond.

Public vs Private: The School Cost Comparison

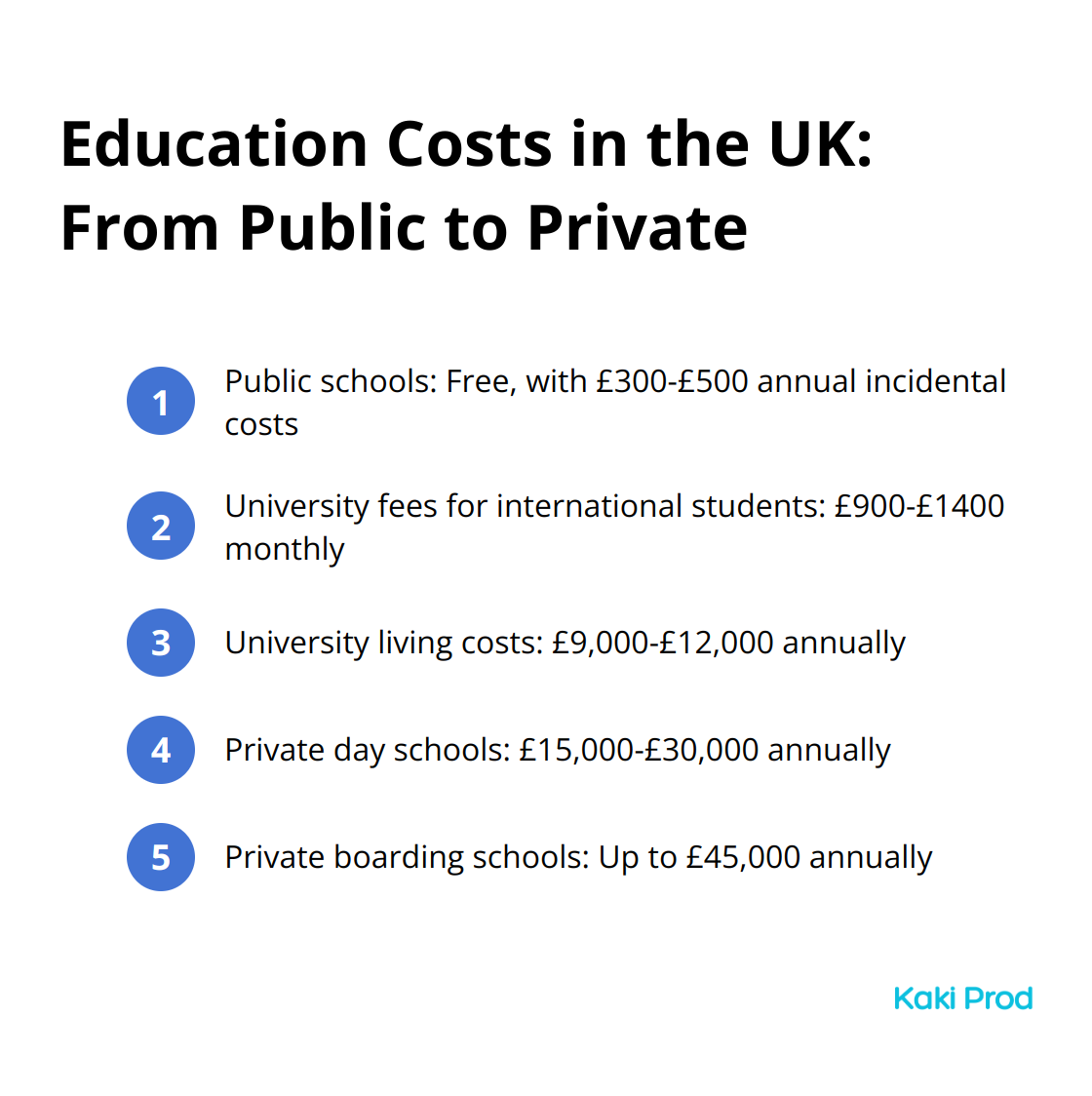

State schools – free as a bird, but don’t pop the champagne just yet. You’ll still need to shell out for uniforms, supplies, and those unforgettable school trips. Calculate about £300 a year for primary school incidentals, ramping up to £500 or more for the older kids.

Now, if you’re eyeing private schools… brace yourself. Day schools will have you parting with £15,000 to £30,000 every year, while boarding schools are in a whole other league, asking up to £45,000 annually. But hey, it boils down to what you value more – your wallet’s weight or a ‘prestigious’ brand name education.

University: The Major Expense

University fees in the UK – buckle up for these bad boys. International students? Grab your calculator, you’re looking at £1300-£1400 monthly in London or £900-£1300 elsewhere in the UK.

Living costs, the saga continues. Studying in London? Better stash away at least £12,000 a year for the basics like a roof over your head and food. Outside London, £9,000 to £11,000 might just cover it.

Scholarships and part-time gigs – not just an option, but a necessity. Plenty of universities dish out financial aid, and the UK is kind enough to let you work up to 20 hours weekly during term time. Take it, it’s a lifeline.

Childcare: The Unexpected Budget Strain

Childcare in the UK – it’ll turn your bank account upside down. Per Money Helper, nursery for the under-twos in England? Try £70.51 for just 10 hours. Ouch.

Nannies could be your alternative – but in London? You’re out £2,000 to £3,000 every month. The rest of the UK is marginally kinder at £1,500 to £2,500.

Want a break? Consider childminders (often softer on the wallet than nurseries) or dive into local parent networks for shared childcare setups. Every little helps.

Lifelong Learning: Self-Investment

Continuing education – it costs, but we’re talking value creation here. Research from the Institute for Fiscal Studies shows employer training budgets dropped 27% per trainee since 2011.

But fret not! Ask around – many firms still offer training perks or study leave. Because a workforce with more skills? It’s their gain too.

Online platforms like Coursera or edX are ready when you are. Loads of courses under £100, or even free. These platforms are golden tickets to upskilling without loosening the purse strings too much.

Final Thoughts

Living in the UK… it’s not a walk in Hyde Park. Financial hurdles? You bet. But knowledge, my friends, is your GPS through this landscape. Housing costs are the heavyweight champ in your expense pile-with London taking the gold for both rent and buying real estate. Everyday costs? They bob and weave depending on where you hang your hat and how you roll. Toss education costs into the mix (especially if you’re an international player or going private), and you’ve got yourself a lively financial cocktail.

The UK, with London as its star, shines bright in the expensive expat clubs worldwide. But wait-Manchester or Glasgow could be your affordable sidekicks, offering a stellar quality of life without an exorbitant price tag. We at Kaki Prod get it… moving isn’t just about the benjamins.

Our comprehensive guides are like your Swiss Army knife for UK relocation-visas, job gigs, cultural nuggets-it’s all there to help you make those big decisions. Sure, living costs are a piece of the puzzle, but let’s zoom out. You’re writing a life story in a place that pulses with diversity. With some strategic Jedi moves and the right toolkit, you’re not just surviving-you’re thriving in the UK’s vibrant scene.