Imagine keeping 100% of your earned income. For many professionals, entrepreneurs, and digital nomads, this isn’t a fantasy but a tangible reality in a select group of nations. The concept of legally paying zero income tax is a powerful financial incentive, capable of dramatically accelerating wealth accumulation, freeing up capital for investment, and providing a higher disposable income for a better quality of life. This guide is designed to move beyond the abstract idea and provide a practical roadmap for those seriously considering a move to one of the world’s premier countries with no tax.

We will explore jurisdictions that have built prosperous economies without levying personal income tax. However, “tax-free” is a nuanced term. While you might escape income tax, other financial obligations like property taxes, import duties, value-added tax (VAT), or corporate taxes may apply. Understanding this distinction is critical for accurate financial planning and avoiding costly surprises.

This comprehensive listicle dives deep into the specifics of each tax haven. For each country, we will dissect the essential details you need to make an informed decision, including:

- Residency and Visa Pathways: Clear, step-by-step requirements for securing legal residency, whether through employment, investment, or other means.

- Cost of Living: A realistic breakdown of expenses, from housing and utilities to groceries and entertainment.

- Pros and Cons: An unbiased look at the lifestyle, business environment, and cultural factors to weigh.

- Actionable Relocation Tips: Practical advice to streamline your move and integration.

Our goal is to equip you with the detailed, actionable information necessary to evaluate if a zero-tax lifestyle is the right strategic move for your personal and financial future.

1. Monaco

Monaco, a glamorous sovereign city-state nestled on the French Riviera, is arguably the most famous tax haven in the world. While it’s not entirely without taxes, its system is so favorable that it stands out as a premier destination for those seeking to legally minimize their tax burden. The principality famously levies no personal income tax, no capital gains tax, and no wealth tax on its residents.

This exceptional tax environment, established in 1869, was a strategic move to attract affluent individuals and foreign investment. The policy has been incredibly successful, transforming Monaco into a global hub for finance, luxury, and high-profile events. The absence of income tax applies regardless of your source of income, whether it’s from local employment, international business ventures, or investment portfolios.

However, it’s important to note that this tax freedom doesn’t apply to everyone. French nationals who cannot prove five years of prior residency in Monaco are still subject to French income tax. Additionally, companies conducting more than 25% of their business outside of Monaco are subject to a corporate profits tax.

Why Monaco is a Premier Tax-Free Destination

Monaco’s appeal extends far beyond its fiscal policies. Its allure is a unique blend of financial advantage, unparalleled security, and an exceptionally high standard of living. For high-net-worth individuals, entrepreneurs, and celebrities, it offers a lifestyle that is both private and prestigious.

The principality’s reputation was significantly boosted by Prince Rainier III and Princess Grace Kelly, who cultivated an image of sophistication and glamour that continues to this day. This legacy is visible in iconic institutions like the Casino de Monte-Carlo and the world-renowned Formula 1 Monte Carlo Grand Prix. The concentration of wealth has also fueled a market for ultra-luxury real estate and exclusive services, attracting business magnates and sports stars like Lewis Hamilton and Novak Djokovic.

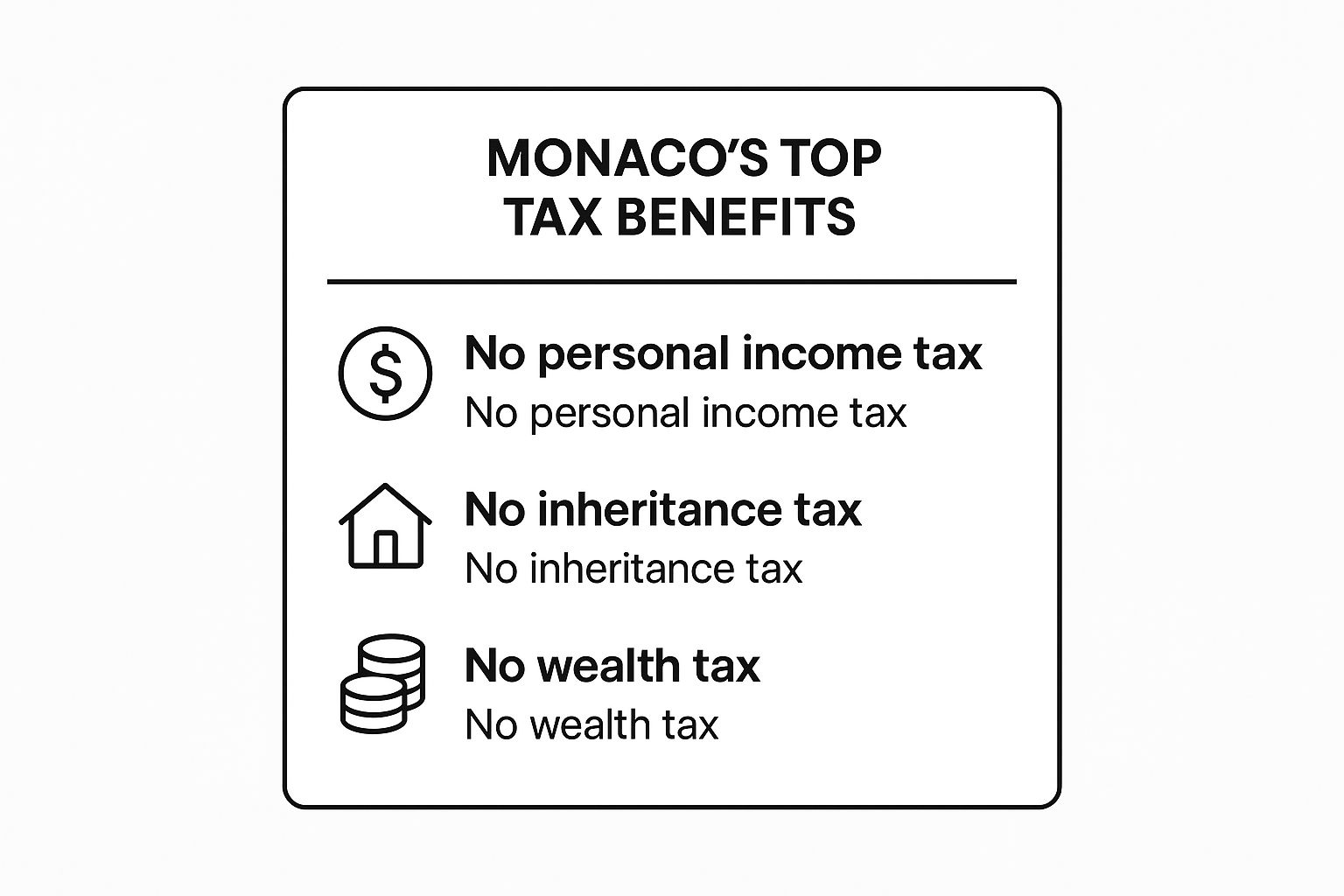

Here is a quick reference summarizing Monaco’s primary tax benefits.

These three core exemptions create a powerful financial incentive, allowing residents to preserve and grow their wealth without the typical tax erosion seen in other high-tax countries.

Practical Steps to Becoming a Resident

Gaining residency in Monaco is a rigorous process designed to attract financially stable and reputable individuals. While challenging, the path is clear for those who meet the criteria.

- Demonstrate Financial Sufficiency: You must open a bank account in Monaco and deposit a substantial amount, typically at least €500,000, though some banks may require more. This proves you can support yourself without relying on the state.

- Secure Accommodation: You need to prove you have a place to live. This can be through purchasing property or leasing an apartment for at least one year. The property must be appropriately sized for your family.

- Pass a Character Check: Applicants must provide a police record from their home country to prove they have a clean criminal record.

- Attend an Official Interview: You will be required to attend a formal interview in Monaco to finalize your application.

Pro Tip: Engaging a local Monégasque legal or advisory firm is highly recommended. They can navigate the specific administrative hurdles, assist with documentation, and ensure your application is positioned for success.

Frequently Asked Questions (FAQ)

Q: How long do I need to live in Monaco to maintain residency?

A: To maintain your tax resident status, you must physically reside in the principality for more than six months (183 days) per year. This is a strict requirement and is actively monitored.

Q: Is Monaco truly a 100% tax-free country?

A: No. While it has no personal income tax, there is a Value Added Tax (VAT) comparable to France’s, and a tax on corporate profits for businesses generating over 25% of their turnover outside Monaco. There are also rental taxes. It is best described as a low-tax, rather than a no-tax, jurisdiction.

Q: What is the cost of living in Monaco?

A: The cost of living is extremely high, among the highest in the world. Real estate is particularly expensive, with prices per square meter far exceeding those in major global cities like New York or London. Daily expenses for groceries, dining, and services are also significantly elevated.

2. United Arab Emirates

The United Arab Emirates (UAE) has rapidly emerged as a leading global business hub and a prominent destination for individuals seeking a tax-efficient lifestyle. Strategically positioned at the crossroads of East and West, the UAE has built a reputation on modern infrastructure, economic stability, and a highly favorable tax system. The cornerstone of its appeal is the complete absence of personal income tax, capital gains tax, and inheritance tax for residents.

This tax-free policy for individuals has been a deliberate strategy to attract international talent, entrepreneurs, and investment. While a federal corporate tax was introduced in 2023, the personal tax framework remains untouched, solidifying the UAE’s status as one of the most attractive countries with no tax on personal income. This environment allows professionals and investors to retain 100% of their earnings, a powerful incentive that has fueled the growth of cities like Dubai and Abu Dhabi.

The UAE’s system is particularly advantageous for businesses operating within its numerous “free zones.” These designated economic areas, such as the Dubai International Financial Centre (DIFC) and Jebel Ali Free Zone, offer additional benefits like 0% corporate tax for qualifying income and 100% foreign ownership, making the UAE a magnet for multinational corporations and startups alike.

Why the UAE is a Premier Tax-Free Destination

The UAE’s allure is a powerful combination of financial incentives, a cosmopolitan lifestyle, and unparalleled opportunities for business growth. Visionary leadership, exemplified by figures like Sheikh Mohammed bin Rashid Al Maktoum, has transformed the desert landscape into a hyper-modern metropolis known for its safety, luxury, and innovation.

This transformation is showcased through world-class events, iconic architecture, and a vibrant social scene that attracts high-net-worth individuals, digital nomads, and families from across the globe. The government’s forward-thinking policies, including long-term residency visas and a welcoming attitude toward expatriates, have created a diverse and dynamic society where over 200 nationalities coexist.

The UAE’s proactive approach to economic diversification ensures it remains a competitive and attractive base for both individuals and global enterprises.

Practical Steps to Becoming a Resident

Gaining residency in the UAE is relatively straightforward compared to other tax havens, with several clear pathways available. The most common routes are tied to employment, property investment, or company formation.

- Secure Employment: The most common method is obtaining a work visa sponsored by a UAE-based employer. The company handles the majority of the application process.

- Invest in Real Estate: The “Golden Visa” program allows for long-term residency (up to 10 years) for individuals who invest a significant amount in local property, typically AED 2 million (approximately $545,000) or more.

- Establish a Company: Entrepreneurs can gain residency by setting up a business in either a mainland or a free zone jurisdiction. This route offers flexibility and is popular with consultants and digital nomads.

- Obtain a Freelance Permit: Several free zones offer freelance permits that come with a residency visa, providing a legitimate way for independent professionals to live and work in the UAE.

Pro Tip: When choosing a residency route, carefully consider your long-term goals. Establishing a company in a free zone can provide significant corporate tax advantages and operational benefits that an employment visa does not.

Frequently Asked Questions (FAQ)

Q: Is the UAE completely tax-free?

A: No. While there is no personal income tax, the UAE has a 5% Value Added Tax (VAT) on most goods and services. A 9% federal corporate tax applies to mainland businesses with profits over AED 375,000, though companies in free zones meeting certain conditions can still benefit from a 0% rate on qualifying income.

Q: What is the cost of living in the UAE?

A: The cost of living varies significantly between emirates. Dubai and Abu Dhabi are comparable to major Western cities, with high costs for rent, international schooling, and entertainment. Emirates like Sharjah or Ras Al Khaimah offer more affordable options while still providing a high quality of life.

Q: How do I prove tax residency in the UAE?

A: To obtain a Tax Residency Certificate (TRC) from the Federal Tax Authority, you generally need to have a valid residency permit, have been in the UAE for at least 183 days in a 12-month period, and have a permanent place of residence (e.g., a tenancy contract). The TRC is essential for claiming benefits under double taxation treaties.

3. Bahrain

Bahrain, an island nation in the Persian Gulf, has established itself as a significant financial hub and an attractive destination for expatriates. A key driver of its appeal is a tax system that is among the most favorable in the world. For individuals, Bahrain levies no personal income tax, no capital gains tax, no wealth tax, and no inheritance tax.

This comprehensive tax-free framework is a cornerstone of Bahrain’s economic strategy, designed to attract foreign talent, investment, and international business. The policy has been highly effective, making the country a prime location for professionals in finance, technology, and the oil and gas sectors. The absence of personal taxes applies to income earned both within and outside of Bahrain, allowing residents to maximize their earnings and savings.

Unlike some other tax havens, Bahrain’s tax benefits are straightforward and apply to all residents, regardless of nationality. However, it’s important to note that the country does have a Value Added Tax (VAT) and imposes social security contributions on employee salaries. Companies operating in the oil and gas sector are also subject to corporate taxation.

Why Bahrain is a Premier Tax-Free Destination

Bahrain’s allure is a powerful combination of financial incentives and a modern, relatively liberal lifestyle compared to some of its regional neighbors. This balance makes it a compelling choice for expatriate professionals, entrepreneurs, and their families looking for one of the top countries with no tax.

The nation’s pro-business environment is heavily promoted by the Bahrain Economic Development Board, which has successfully positioned the country as a gateway to the Gulf market. Major developments like the Bahrain Financial Harbour stand as testaments to its status as a regional banking and financial services leader. This has attracted numerous multinational corporations to set up their regional headquarters, creating a vibrant job market for skilled professionals.

Here is a quick reference summarizing Bahrain’s primary tax benefits.

- No Personal Income Tax: Keep 100% of your salary and other personal income.

- No Capital Gains Tax: Profits from selling assets like stocks or property are not taxed.

- No Wealth or Inheritance Tax: Your accumulated wealth and assets can be passed on without tax deductions.

These fundamental exemptions provide a clear and powerful financial advantage for residents, fostering an environment where personal wealth can be built and preserved efficiently.

Practical Steps to Becoming a Resident

Gaining residency in Bahrain is typically tied to employment, investment, or property ownership. The process is generally considered more streamlined than in other Gulf nations.

- Secure Employment: The most common path is obtaining a work permit through a local employer. Your employer will sponsor your visa and handle the majority of the administrative process.

- Invest in a Business: Entrepreneurs can obtain residency by starting a business in Bahrain. This requires a detailed business plan and adherence to the country’s commercial registration laws.

- Property Ownership: Foreigners who purchase property of a certain value (currently BHD 50,000 or more) in designated freehold areas can apply for a self-sponsorship residence permit.

- Pass a Medical Examination: All applicants for residency must undergo a medical check-up at an approved clinic in Bahrain.

Pro Tip: Familiarize yourself with local business customs. Networking is crucial in Bahrain’s business culture, and building strong personal relationships can be just as important as your professional qualifications.

Frequently Asked Questions (FAQ)

Q: Are there any taxes at all in Bahrain?

A: Yes. While there is no personal income tax, there is a 10% Value Added Tax (VAT) on most goods and services. Social security contributions are also mandatory, with a portion deducted from employee salaries. Additionally, specific industries like oil and gas face corporate taxes.

Q: What is the cost of living in Bahrain?

A: The cost of living is generally lower than in neighboring hubs like Dubai or Abu Dhabi. Accommodation, transportation, and daily expenses are more affordable, making it an attractive option for expatriates seeking to maximize their tax-free income.

Q: Is Bahrain a stable country for long-term residency?

A: Bahrain is considered a stable and safe country with a well-developed infrastructure and a high standard of living. However, like any country in the region, it is wise for potential residents to stay informed about the regional political climate when making long-term plans.

4. Qatar

Fueled by immense natural gas wealth, Qatar has transformed itself into a futuristic and prosperous nation on the Arabian Peninsula. For expatriate professionals, its most compelling feature is its status as a true tax-free country. Qatar imposes no personal income tax, no capital gains tax, and no inheritance or gift tax on individuals, making it an exceptionally attractive destination for those looking to maximize their earnings.

This tax-free policy is a cornerstone of Qatar’s strategy to attract top global talent to drive its rapidly diversifying economy. Professionals in sectors like oil and gas, finance, technology, and construction find that their entire salary is their take-home pay, a powerful financial incentive. This approach has helped build a modern, high-quality living environment with world-class infrastructure, as showcased during the FIFA World Cup 2022.

While there is no income tax for individuals, businesses are subject to a corporate income tax, typically at a flat rate of 10%. However, companies operating within the Qatar Financial Centre (QFC) can benefit from a specific tax regime.

Why Qatar is a Premier Tax-Free Destination

Qatar’s appeal lies in its combination of high earning potential and a high standard of living, supported by massive state investment. The country offers a safe, family-friendly environment with excellent international schools, advanced healthcare facilities, and a wealth of leisure and cultural attractions, from the Museum of Islamic Art to luxurious shopping malls.

The successful hosting of the FIFA World Cup 2022 massively boosted its global profile, demonstrating its capability to manage mega-projects and welcome the world. This has further spurred development, creating opportunities for international consultants, event managers, and service industry professionals. Major entities like the Qatar Investment Authority and Al Jazeera Media Network are based here, cementing its role as a significant regional hub for finance and media.

Practical Steps to Becoming a Resident

Residency in Qatar is almost always tied to employment. Unlike other tax havens that offer residency through investment, the primary pathway for expatriates is securing a job.

- Secure a Job Offer: The first and most crucial step is to receive a formal employment offer from a Qatari company. Your employer will act as your sponsor for your residence permit.

- Obtain a Work Visa: Your employer will initiate the visa process. This involves submitting your educational and professional credentials, which must be officially attested, along with a medical examination.

- Complete the Residency Permit Process: Upon arrival in Qatar, you will undergo a medical check (including a blood test and chest X-ray) and have your fingerprints taken. Once these are cleared, your employer will finalize the application for your Qatar ID and Residence Permit.

- Family Sponsorship: Once your own residency is secured, you can sponsor your immediate family members (spouse and children), provided you meet a minimum salary threshold.

Pro Tip: When negotiating your employment contract, look for a comprehensive package. Many employers in Qatar offer benefits like housing allowances, transportation, health insurance, and annual flight tickets home, which can significantly reduce your cost of living.

Frequently Asked Questions (FAQ)

Q: Can I get permanent residency in Qatar?

A: Permanent residency is very rare and granted to only a very limited number of individuals who meet strict criteria, such as residing in the country for 20 years and demonstrating fluency in Arabic. Most expatriates live in Qatar on renewable work-sponsored residence permits.

Q: Are there any hidden taxes or fees I should know about?

A: While there is no income tax, there are other costs. A 5% Value Added Tax (VAT) is expected to be introduced in the future, though it is not yet implemented. There are also import duties on certain goods, and various government service fees for visa processing and other administrative tasks.

Q: What is the cost of living in Qatar?

A: The cost of living is high, especially for accommodation in desirable areas of Doha. However, it can be offset by high, tax-free salaries and generous employment packages. Groceries, transportation, and utilities are generally more affordable than in other major global hubs.

5. Kuwait

Kuwait, a small yet immensely wealthy nation at the northern end of the Persian Gulf, stands out as one of the world’s most complete tax-free environments. Driven by vast oil reserves, the country offers its residents a remarkable fiscal advantage: no personal income tax, no capital gains tax, and no wealth or inheritance taxes.

This tax-free policy is a cornerstone of the Kuwaiti economy, designed to attract skilled foreign talent to fuel its development and diversify its industries beyond oil and gas. Unlike some tax havens that cater primarily to high-net-worth individuals for residency-only purposes, Kuwait’s model is intrinsically linked to employment. The absence of income tax applies to all residents, including the large expatriate workforce, making it a powerful magnet for professionals seeking to maximize their earnings.

It is crucial to understand that Kuwait’s tax system is structured to support its local economy. While individuals enjoy a tax-free existence, foreign corporations operating in the country are subject to a corporate income tax. However, for the individual professional, the financial benefits are direct and substantial.

Why Kuwait is a Premier Tax-Free Destination

Kuwait’s appeal lies in its straightforward and highly lucrative proposition for expatriate professionals. The combination of high, tax-free salaries and a government-funded infrastructure creates an environment where aggressive saving and investment are possible. This makes it an exceptional destination for those on a specific career or financial mission.

The country’s economic engine is powered by state-owned enterprises like the Kuwait Petroleum Corporation and the Kuwait Investment Authority, one of the world’s oldest sovereign wealth funds. These institutions drive demand for international expertise in sectors ranging from finance and engineering to healthcare and education. As a result, professional communities of expatriates from around the globe have flourished, creating a unique, multicultural society within a traditional Arab framework.

Practical Example: An experienced project manager from the UK earning £90,000 annually might pay around £23,000 in income tax and National Insurance, leaving them with £67,000. In Kuwait, a similar role could offer a tax-free salary of £90,000, allowing for an additional £23,000 in savings or disposable income per year.

Practical Steps to Becoming a Resident

Residency in Kuwait is almost exclusively tied to employment. It is not a destination for passive residency; you must be sponsored by a Kuwaiti employer to live and work in the country.

- Secure a Job Offer: The first and most critical step is to obtain a formal employment offer from a company based in Kuwait. This company will act as your official sponsor (known as a “kafeel”).

- Obtain a Work Visa: Your sponsoring employer will manage the application process for your work visa and residency permit (Iqama). This involves submitting your educational qualifications, a medical examination, and security clearance.

- Understand Sponsorship: Your legal right to reside in Kuwait is directly linked to your sponsor. Changing jobs requires a formal transfer of sponsorship, a process that must be managed carefully with your old and new employers.

- Respect Local Laws: Adherence to local customs and regulations is paramount. While a modern business hub, Kuwait is a conservative Islamic country, and respect for its cultural norms is essential for a successful stay.

Pro Tip: Before accepting a role, thoroughly vet your potential employer’s reputation for managing expatriate affairs. A reliable and experienced sponsor can make the entire residency and employment process significantly smoother.

Frequently Asked Questions (FAQ)

Q: Is there any form of tax in Kuwait?

A: While there is no personal income tax, there is a corporate income tax on foreign companies. Additionally, there are social security contributions required for Kuwaiti employees, but expatriates are typically exempt. It is one of the most comprehensive “countries with no tax” for individuals.

Q: Can I get permanent residency or citizenship in Kuwait?

A: No, this is extremely difficult. Residency is tied to your employment contract. It is not a country where expatriates can typically plan for long-term settlement, permanent residency, or citizenship. Most professionals work in Kuwait for a set period to achieve specific financial goals before moving on.

Q: What is the cost of living in Kuwait?

A: The cost of living is moderate compared to other Gulf hubs like Dubai or Doha. Accommodation is the largest expense, but groceries, transportation, and dining can be quite reasonable. The absence of tax often more than compensates for the living costs, allowing for a high savings rate.

6. Oman

Oman offers a compelling and culturally rich alternative to the high-octane glamour of its Gulf neighbors. As one of the key countries with no tax, it provides a stable and welcoming environment for expatriates. The Sultanate of Oman levies no personal income tax, no capital gains tax on individuals, and no net wealth tax, making it an attractive destination for professionals and entrepreneurs.

This tax-free policy for individuals is a cornerstone of Oman’s strategy to attract skilled foreign talent and stimulate economic growth beyond its traditional oil and gas sectors. Under the visionary leadership of the late Sultan Qaboos bin Said, Oman embarked on a path of modernization and diversification. This has created a landscape where income earned, whether from local employment or foreign sources, remains entirely yours.

Unlike some other tax havens, Oman combines its fiscal benefits with a more moderate cost of living and a deep emphasis on cultural heritage and natural beauty. This makes it particularly appealing for those who seek not just financial advantage but also a high quality of life, from adventure tourism professionals exploring its wadis and mountains to entrepreneurs tapping into its growing logistics and technology hubs.

Why Oman is a Unique Tax-Free Destination

Oman’s appeal lies in its authentic blend of modern opportunity and ancient tradition. It provides a tax-efficient base without the intense, fast-paced lifestyle of other Gulf metropolises, offering a more tranquil and family-friendly atmosphere. The country’s stability and safety are renowned throughout the region.

The government’s “Oman Vision 2040” plan is actively diversifying the economy, creating new opportunities in sectors like tourism, logistics, fisheries, and renewable energy. This forward-thinking approach means that professionals in fields such as hospitality, construction, education, and healthcare are in high demand. The country’s stunning natural landscapes, from pristine coastlines to dramatic mountain ranges, have also made it a hotspot for adventure tourism, attracting a different kind of expatriate.

Practical Example: A hospitality manager moving from Europe to a luxury resort in Muscat not only benefits from a 0% income tax rate but also enjoys a lower cost of living compared to Dubai. This dual advantage means a larger portion of their salary can be allocated to savings, travel, or enjoying Oman’s outdoor activities.

Practical Steps to Becoming a Resident

Securing residency in Oman is typically tied to employment or investment. The process is relatively straightforward compared to other jurisdictions in the region, especially if you have a job offer in hand.

- Secure an Employment Offer: The most common route is to obtain a job offer from an Omani company. Your employer will then act as your sponsor and manage the visa application process on your behalf.

- Obtain a “No Objection Certificate” (NOC): Your sponsoring company will secure an NOC from the Royal Oman Police, a crucial first step for your employment visa.

- Undergo a Medical Examination: All applicants must pass a medical test in their home country at an approved clinic, and often again upon arrival in Oman, to screen for certain communicable diseases.

- Attest Your Documents: Your educational and professional qualifications will need to be attested by various government bodies, including the Omani embassy in your home country.

Pro Tip: Networking is vital in Oman’s business culture. Use platforms like LinkedIn to connect with professionals in your industry or engage with the Oman American Business Center (AmCham Oman) to understand the local market before making a move.

Frequently Asked Questions (FAQ)

Q: Do I need to live in Oman year-round to be a tax resident?

A: Residency is tied to your employment visa and sponsorship, not a specific number of days. As long as your residence card is valid and you are employed by your sponsor, you maintain your resident status. However, extended absences can affect the renewal of your visa.

Q: Are there any taxes at all in Oman?

A: Yes. While there is no personal income tax, Oman introduced a 5% Value Added Tax (VAT) in 2021. There is also a corporate income tax (CIT) of 15% that applies to most businesses, and municipalities charge a small tax on property rentals.

Q: What is the cost of living in Oman like?

A: The cost of living in Oman is generally lower than in neighboring countries like the UAE or Qatar. Accommodation, in particular, can be more affordable. However, costs can vary significantly between the capital, Muscat, and other cities.

7. Saudi Arabia

Saudi Arabia, a dominant force in the global energy market, is rapidly transforming its economy under the ambitious Vision 2030 framework. A key incentive for attracting international talent to fuel this growth is its highly favorable tax system. The Kingdom famously levies no personal income tax on its residents, regardless of their profession or nationality.

This zero-income-tax policy has long been a feature of the Saudi economy, primarily for expatriate workers. However, with the large-scale economic diversification driven by Crown Prince Mohammed bin Salman, it has become a central pillar in attracting top-tier professionals, entrepreneurs, and consultants from around the world. Whether you are an engineer working on the futuristic NEOM mega-city, a financial analyst in Riyadh, or a project manager for a Vision 2030 initiative, your salary is not subject to income tax deductions.

It is crucial to understand that while personal income is untaxed, the country does have other forms of taxation. There is a Value Added Tax (VAT) on goods and services, and businesses are subject to corporate income tax and Zakat (a religious wealth tax for Saudi nationals and GCC citizens). Despite this, for individuals, the absence of income tax remains a powerful financial draw.

Why Saudi Arabia is an Emerging Tax-Free Hub

Saudi Arabia’s appeal is shifting from being purely an oil-and-gas destination to a burgeoning center for innovation, technology, and large-scale development. The country is investing trillions of dollars into new sectors, creating unprecedented opportunities for skilled foreign workers who can benefit directly from the tax-free salary environment.

The Vision 2030 program is the main catalyst, with giga-projects like NEOM, the Red Sea Project, and Qiddiya attracting a global workforce. The Kingdom is actively courting international experts in fields like technology, tourism, entertainment, and logistics. This state-led transformation offers a unique chance to be part of a historic economic shift while enjoying significant financial benefits.

Here is a quick reference summarizing Saudi Arabia’s primary tax benefits for individuals.

These key exemptions allow professionals to maximize their earnings and savings potential, making the Kingdom an increasingly competitive choice for expatriates.

Practical Steps to Becoming a Resident

Residency in Saudi Arabia is almost always tied to employment. The most common path is through a work visa sponsored by a Saudi-based employer.

- Secure a Job Offer: The first and most critical step is to obtain a formal employment contract from a company registered in Saudi Arabia. This company will act as your sponsor.

- Obtain a Work Visa: Your employer will initiate the visa process. This involves submitting your qualifications, medical examination results, and other required documents to the Saudi authorities.

- Receive Your Residence Permit (Iqama): Upon arrival in Saudi Arabia, your employer will process your application for an Iqama. This is your official residence and identity card, which is typically renewed annually.

- Understand Sponsorship: Your legal status in the country is tied to your sponsor (employer). Changing jobs requires a formal transfer of sponsorship.

Pro Tip: Focus your job search on sectors aligned with Vision 2030, such as technology, sustainable energy, tourism, and project management. Companies involved in giga-projects are often actively recruiting international talent and are experienced in handling the visa and residency process.

Frequently Asked Questions (FAQ)

Q: Is all income in Saudi Arabia tax-free?

A: For individuals, salary and employment income are tax-free. However, self-employed individuals and businesses operating in the Kingdom are subject to different tax regulations, including corporate income tax. It’s essential to distinguish between personal employment income and business income.

Q: Do I need to be Muslim to live and work in Saudi Arabia?

A: No. Saudi Arabia welcomes professionals from all religious backgrounds. While the country’s laws are based on Islamic principles, expatriates are able to live and work there freely, provided they respect local laws and cultural customs.

Q: What is the cost of living like in Saudi Arabia?

A: The cost of living can vary significantly between cities like Riyadh, Jeddah, and Dammam. While everyday goods and services are generally affordable, accommodation, particularly in expatriate compounds, can be expensive. However, many employers offer generous housing allowances as part of their compensation packages, which, combined with a tax-free salary, often results in a high standard of living.

Tax-Free Countries Comparison of 7 Nations

| Country | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Monaco | High – stringent residency & investment rules | Very high – costly real estate & minimum investments | Exceptional tax savings; luxury lifestyle | Ultra-high-net-worth individuals seeking tax efficiency and exclusivity | No personal income tax; strong privacy; political stability |

| United Arab Emirates | Moderate – requires business setup or residency | Moderate – free zones ease establishment | Strong tax benefits with business and lifestyle growth | Entrepreneurs, international businesses, digital nomads | No personal income tax; strategic location; free zones with 0% corp tax |

| Bahrain | Moderate – easier residency, financial sector focus | Low to moderate – lower living costs than UAE | Tax-free personal income with stable financial services | Financial professionals and regional business hubs | No personal income tax; liberal social environment; strong financial sector |

| Qatar | Moderate – employment-based residency | Moderate to high – high living costs | Tax-free salaries; modern infrastructure | Expat professionals in oil, gas, finance, and consulting | No personal income tax; high living standards; strategic location |

| Kuwait | Moderate – visa sponsorship needed | Moderate – subsidies offset some costs | Completely tax free; strong salaries | Skilled professionals seeking tax exemptions | No personal income tax; subsidized utilities; strong currency stability |

| Oman | Low to moderate – easier access but slower growth | Low to moderate – lower costs of living | Tax-free income; growing diversification | Small business owners and tourism sector workers | No personal income tax; moderate social environment; natural beauty |

| Saudi Arabia | High – complex legal and cultural environment | Moderate to high – evolving opportunities | Tax-free personal income; major economic transformation | Professionals aligned with Vision 2030 sectors | No personal income tax; large market; extensive gov investments |

Navigating Your Path to a Tax-Free Future

The journey through the world’s most prominent countries with no tax reveals a landscape rich with opportunity but paved with unique challenges. As we’ve explored, from the sun-drenched glamour of Monaco to the futuristic ambition of the United Arab Emirates and the deep-rooted traditions of Saudi Arabia, the absence of personal income tax is a powerful magnet. Yet, this single benefit is just the first chapter of a much more complex story. The real takeaway is that “tax-free” is not a one-size-fits-all solution; it is a highly personal equation that must be balanced against your individual career goals, lifestyle preferences, and financial circumstances.

What truly distinguishes these nations is not just what they don’t take, but what they do offer in return. The Middle Eastern hubs-the UAE, Qatar, Bahrain, Kuwait, Oman, and Saudi Arabia-leverage their vast hydrocarbon wealth to build world-class infrastructure, high-paying job markets, and incredibly safe living environments. Monaco, on the other hand, trades on exclusivity, security, and a prestigious European address. The key insight is to look beyond the headline perk of zero income tax and evaluate the entire ecosystem.

Key Takeaway: The most successful international relocations are not just about finding a tax haven. They are about finding a life haven-a place where the economic benefits align seamlessly with your professional ambitions and personal well-being.

From Dream to Reality: Your Actionable Next Steps

Making the leap to one of these jurisdictions requires diligent planning and a strategic approach. It’s time to move from passive reading to active preparation. Here’s a practical roadmap to guide your next moves:

-

Conduct a Deep-Dive Self-Assessment: Go beyond a simple pros and cons list. Create a detailed spreadsheet comparing your top two or three choices against your non-negotiables. Quantify factors like desired salary (after accounting for living costs), career growth potential in your specific industry, proximity to family, and lifestyle elements like access to nature, urban amenities, or cultural activities.

-

Initiate a “Financial Fire Drill”: Before you even apply for a visa, simulate your potential budget. Use online cost-of-living calculators (like Numbeo or Expatistan) to create a mock monthly budget for your target city. Factor in realistic costs for rent (the biggest expense), utilities, groceries, transportation, and entertainment. This exercise will reveal the true financial impact of the move and highlight how much you can actually save.

-

Engage with Expat Communities: Theory is good, but firsthand experience is better. Join expat forums on platforms like Facebook, Reddit (e.g., r/dubai, r/qatar), or InterNations. Don’t just lurk; ask specific, well-researched questions. For example, instead of asking “Is Dubai expensive?” ask, “For a software engineer living in the Marina, what is a realistic monthly budget for groceries and utilities, excluding rent?”

-

Review Your “Tax Home” Obligations: This is a critical, often-overlooked step. Consult with a tax advisor who specializes in expatriate tax law for your home country. Understand your obligations for filing taxes back home, the implications of the Foreign Account Tax Compliance Act (FATCA) if you’re a U.S. citizen, and how to properly sever tax residency to avoid double taxation issues down the line. Realizing you still owe significant taxes back home after you’ve moved can be a costly mistake.

Frequently Asked Questions

Q: Is “tax-free” truly free? What are the hidden costs?

A: No, it’s not entirely free. While you won’t pay income tax, you will face other costs. These often include high initial setup fees for residency, significant rental deposits, government service fees, and often a higher cost of living for imported goods. Additionally, many Gulf countries have implemented a Value-Added Tax (VAT) on goods and services, which is a form of indirect taxation.

Q: As an American, can I really stop paying U.S. taxes by moving to one of these countries?

A: It’s complicated. The United States taxes its citizens based on citizenship, not residency. This means that even if you live in a tax-free country like the UAE, you are still required to file a U.S. tax return each year. However, you can often use mechanisms like the Foreign Earned Income Exclusion (FEIE) or Foreign Tax Credit (FTC) to significantly reduce or eliminate your U.S. tax liability, but professional tax advice is essential.

Q: Which country is best for entrepreneurs?

A: The United Arab Emirates, particularly Dubai, is widely regarded as the most favorable for entrepreneurs. Its free zones offer 100% foreign ownership, zero corporate and income tax, and streamlined business setup processes. Bahrain is also emerging as a strong contender with a focus on startups and lower operating costs compared to the UAE.

Mastering the nuances of relocating to countries with no tax is about strategic foresight. By treating your move like a meticulous business plan, you transform a daunting prospect into a calculated and achievable life upgrade. The financial freedom and unique experiences awaiting you are immense, but they reward the prepared.

Navigating the complex visa applications, legal documentation, and residency requirements for these destinations can be overwhelming. KakiProd specializes in simplifying this process, providing guidance and streamlined services to help you secure the right visa for your move to a tax-free country. Explore our personalized relocation tool at KakiProd.