At Kaki Prod, we get it — trying to figure out healthcare in a foreign land can feel like you’re stuck in a Kafka novel. So here’s the lowdown in 2025 on how expats can tackle the healthcare maze with a bit more swagger.

This isn’t just a guide — it’s your survival kit, covering all the nuts and bolts from healthcare models that seem designed to confuse to the must-know tips for expats hunting for decent medical care abroad. Plus, we’ll spotlight the top dog healthcare systems where expats really hit the jackpot across various countries.

How Global Healthcare Systems Work in 2025

Alright, let’s dissect the global healthcare landscape-because it’s as varied as the countries it serves. If you’re an expat (or planning to be one), wrapping your head around this stuff can make or break your experience abroad. So, what are the main types of systems running the show in 2025? Let’s dive in.

Public Healthcare: The Backbone of Many Nations

Public healthcare, fueled by tax dollars, still stands tall in spots like the UK, Canada, and Spain. These models offer broad coverage to residents, including expats who’ve settled in for the long haul.

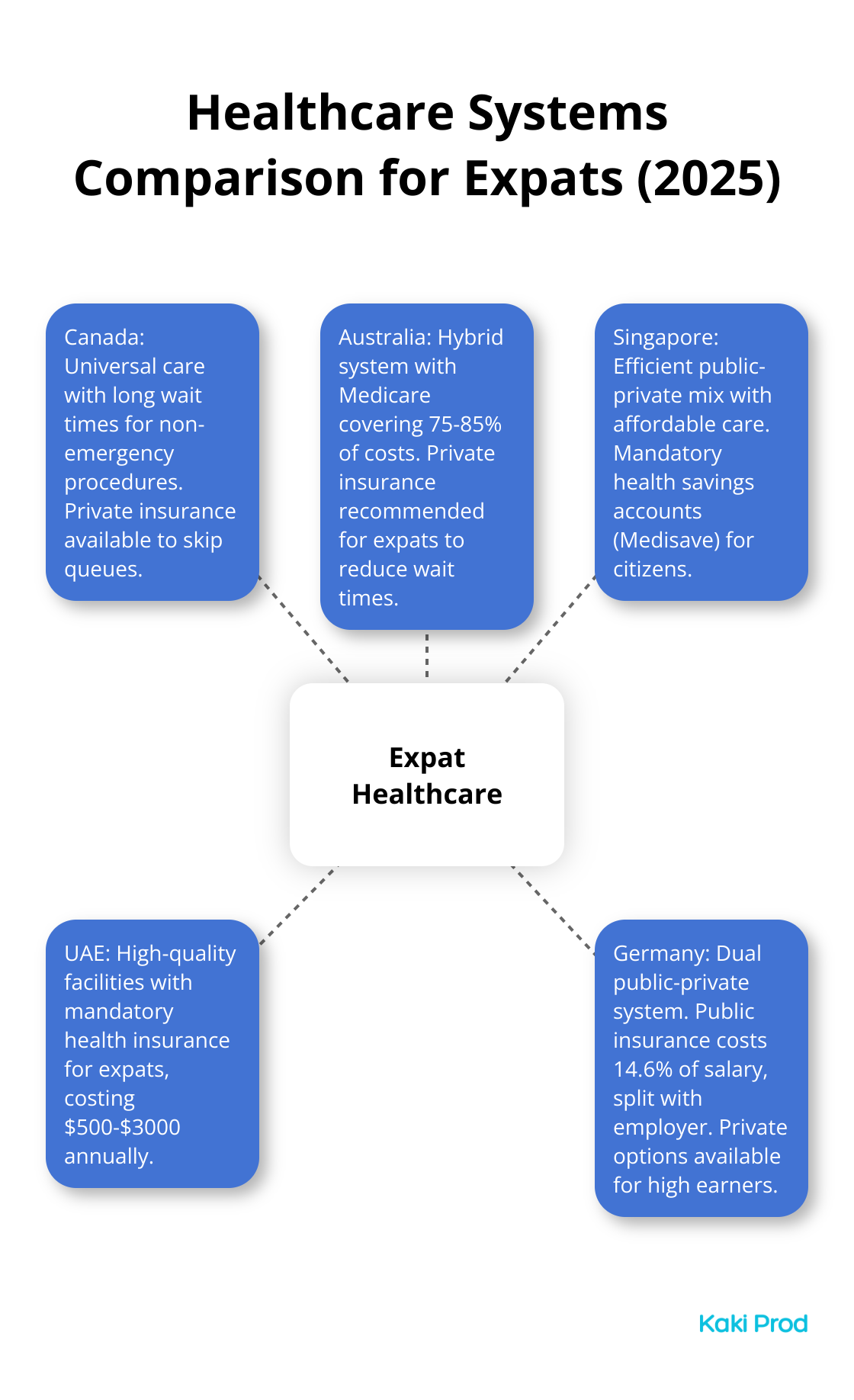

In Canada, it’s mostly smooth sailing-no bills for most medical tabs. But there’s a hitch… wait times for non-emergency procedures. Remember that 2024 report from the Canadian Institute for Health Information? They pegged the median wait for hip or knee surgeries longer than in 2019.

Private Healthcare: Fast Lane to Care-at a Price

The US is front and center when it comes to private healthcare-it’s the main act. And elsewhere? It complements what’s publicly available. Think speedier specialist visits and a personal touch, if you’re willing to cough up the cash.

Take the UAE, a hotbed for expats, where private healthcare is booming. Heading to Dubai? Get ready to shell out for health insurance-between $500 to $3000 annually-courtesy of mandatory coverage rules.

Universal Healthcare: Covering All the Bases

Universal healthcare looks to make health services reachable for everyone. Germany’s playing at this game by mixing public and private elements. The World Health Organization is shooting for 1 billion more folks under such umbrellas by 2025.

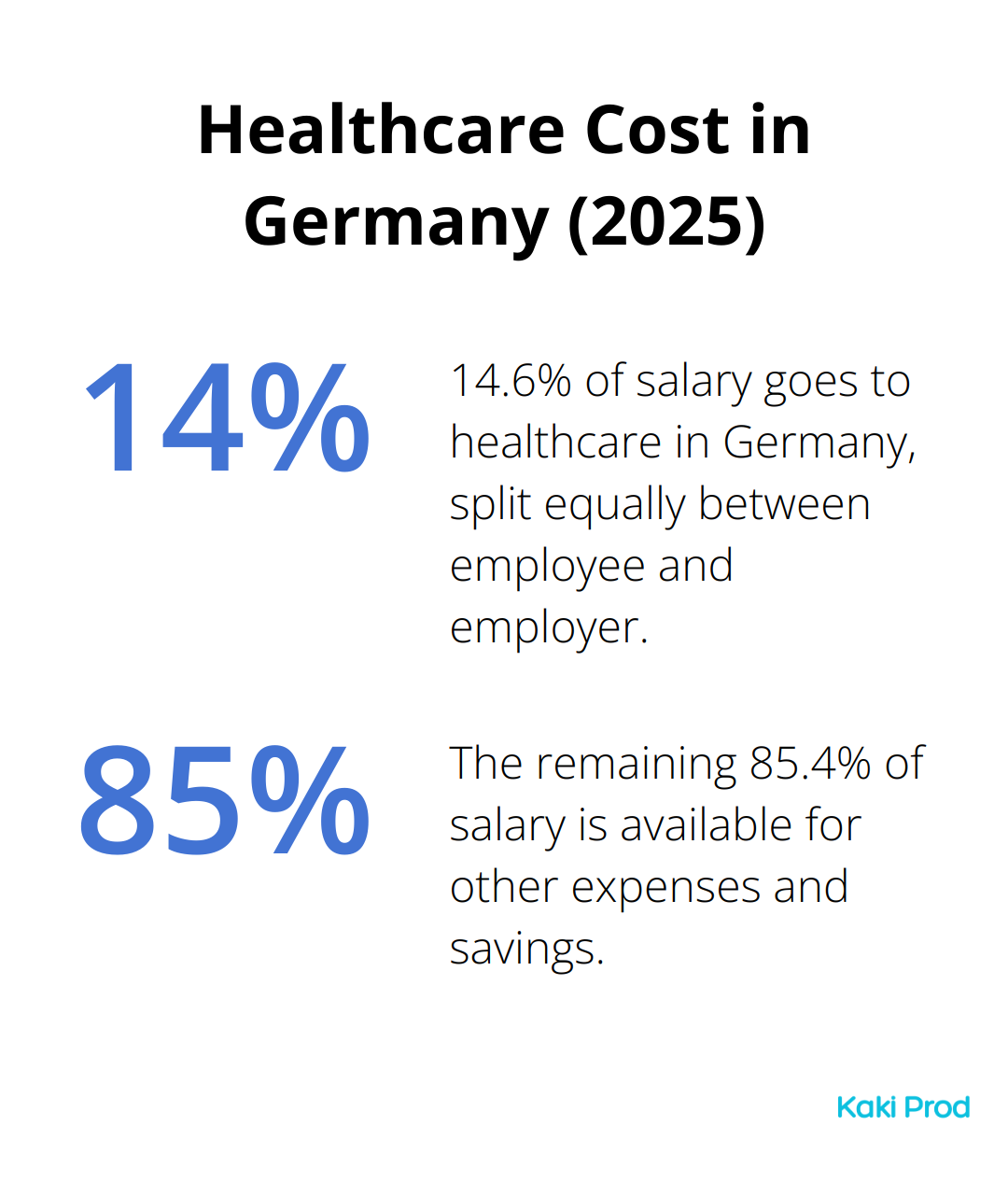

In Germany, insurance is non-negotiable. Public insurance (they call it gesetzliche Krankenversicherung) will knock 14.6% off your earnings, split with your boss. For a €50,000 paycheck, expect about €305 vanishing monthly for that extensive coverage.

Out-of-Pocket Systems: Financial Roulette

Then you have countries where folks primarily pay medical bills out of pocket-big risk, little taxes. But you’re rolling the dice on potential financial chaos.

In India, despite moves to beef up public coverage, out-of-pocket spending lingers high. If India’s your next stop, patch up those risks with sound international health insurance.

The Hybrid Approach: Picking the Best of Both Worlds

Many nations are now opting for hybrid models, combining public stability with private perks. Australia’s Medicare is one such recipe, offering basic coverage while private insurance sweetens the pot with extras.

In Australia, Medicare picks up the tab on about 75% of GP costs, 85% for specialist services, and all at public hospitals. Yet, expats often go private to cut line for elective surgeries and private hospital beds.

So, what’s the takeaway? Navigating these myriad healthcare systems isn’t just art-it needs strategy. The next bit will spotlight the critical angles expats have to ponder while tackling foreign healthcare mazes.

Expat Healthcare Essentials: Navigating Foreign Medical Systems in 2025

Insurance: Your Healthcare Safety Net

Alright, let’s get into it – health insurance is your go-to buddy when diving into expat life. International health insurance policies give you worldwide coverage and sweet perks like emergency evacuation. Top picks? Cigna Global, GeoBlue, William Russell, and International Medical Group. If you’re taking the plunge and moving abroad, these guys have your back.

Now, a little insight – per the International Health Insurance Association’s 2024 survey, you’re looking at $200 to $600 monthly for solid expat health insurance. What affects these numbers? Age, level of coverage, and where you’re calling home (shocker: U.S. coverage is pricey because… healthcare costs).

Heads up – some places won’t let you touch down without mandatory health insurance. Case in point: in Dubai, you’re putting $500 to $3000 annually on the table for it. Do your homework on local rules before your big move.

Decoding Local Healthcare Costs

Brace yourself – getting the lowdown on local healthcare costs is vital. An ER visit in the U.S.? That’ll hit you for $700 to $3,400. But, hop over to Thailand, and that number drops to a cool $30 to $100.

Routine care? Also all over the map. A run-of-the-mill GP visit in France? Around $25. Over in Singapore, you’re shelling out $50 to $80. And here’s a tip: always get a price estimate upfront and hang on to those receipts for insurance claims.

Bridging the Language Gap

Here’s the deal – language barriers in healthcare settings can crank up the stress levels for expats. Enter interpreter services – lifesavers in this scenario. These folks help you explain symptoms and decode diagnoses like pros.

Want to bust through language obstacles? Here’s what you do:

- Nail down key medical phrases in the local lingo.

- Lean on medical translation apps like MediBabble or Canopy Speak.

- Aim for hospitals that cater to international folks. (Bumrungrad International Hospital in Bangkok? They’ve got interpreters for over 20 languages-impressive.)

Adapting to Cultural Healthcare Norms

Roll with the punches, because healthcare practices? They change big time across cultures. Some countries’ docs are all about straight talk, while others like to take the softer route.

In Japan, doctors might sidestep giving the bad news directly to you, preferring to loop in family first. Contrast that with Germany, where docs are direct – jarring for some, sure, but it’s how they roll.

Alternative medicine? Another cultural curveball. China blurs the traditional and Western lines seamlessly. Keep an open mind, but always run anything new by your primary care doc.

As you’re gearing up to navigate your career abroad, factor in how these healthcare nuances will shape your adventure. Stick around – next up, we’re diving into the crème de la crème of healthcare systems for expats in 2025, helping you make savvy choices about your next home base.

Where Are the Best Healthcare Systems for Expats in 2025?

Canada: Universal Care with a Side of Patience

Let’s talk about Canada-a land of universal healthcare and, well, waiting rooms. Covers most of the essentials, no out-of-pocket for you. But buckle up for those waits… not all maple syrup and hockey, folks.

Non-emergency procedures? You might need a book for the waiting game. Get a load of this- MRI waits went up 15 days in 2024 compared to pre-pandemic. More if you’re hankering for a CT scan.

Some expats-those crafty folks-grab extra private insurance to skip the line. Not a bargain, but it’s your fast pass to specialists and optional surgeries.

Australia: The Best of Both Worlds

Australia’s one-two punch of public and private care-gotta admit, they might just have nailed it. Medicare gets you 75% off GP costs, 85% of specialist services, the whole shebang covered in public hospitals.

Now, expats, listen up. Private insurance is your buddy here. Cuts down elective surgery waits, lets you waltz into private hospitals. Plus, tax breaks from the Australian government-who doesn’t love a good incentive?

Visa types, though-check ’em. Some want that private health cover from day one.

Singapore: Efficiency is the Name of the Game

Singapore-smooth operator in the healthcare world. Consistently scoring high, a perfect cocktail of public and private care. Prevention on point, costs staying chill.

Expats? High-quality care without the drama of emptying your life savings. $50 to $80 for a GP visit-a mere drop compared to Western shores.

And here’s a twist-Singapore’s mandatory health savings accounts, aka Medisave. A smart national scheme-stash some income for medical needs. Plan this one out, folks.

UAE: The Rising Star of Healthcare

Over in the United Arab Emirates-particularly Dubai and Abu Dhabi-they’re throwing money at health infrastructure. Expats get a slice of those top-notch facilities, globetrotter doctors included.

Health insurance-it’s a must. $500 to $3000 annually but hey, the coverage is solid and you’ll breeze through waits.

Employer-sponsored health insurance? Many do it, but get your magnifying glass out-coverage ain’t the same across the board. Make this negotiation material when packing your expat bags.

Germany: A Dual System That Works

Germany’s dual public-private system-flexible, comprehensive, kind of the health system MVP. Public insurance takes 14.6% of earnings, split with your boss. Making €50,000? You’re looking at €305 monthly, solid coverage included.

High rollers opt for private coverage, special perks thrown in. Good news is, you’ll face shorter waits than in quite a few European spots.

A tip-learn some basic medical German phrases. Sure, many docs speak English but a sprinkle of German eases appointment dramas.

Now, thinking about where to land? Check out the best countries for expats in 2025. Each spot’s got its quirks and charms, so do your homework for the smooth expat ride.

Final Thoughts

Let’s talk expat healthcare in 2025. Step one – prep like your life depends on it (because it kind of does). Dive into the healthcare situation, get the lowdown on insurance ins and outs, and figure out how not to accidentally offend folks in your new neck of the woods. This info? It’s your golden ticket when the time comes to play doctor abroad.

Now, the healthcare costs dance – it can be a doozy. Some places? Top-notch care without nuking your bank account. Others? They’ll take you for a financial ride. Here’s the strategy: size up your health checklist, figure out how much you’re willing to shell out, and see how big of a gamble you’re willing to take on medical roulette when picking a place to settle and a plan to stick with.

Kaki Prod is your navigator on this journey. They’ve got the 411 on everything expat healthcare-related. From visas to local customs – the whole shebang. Their mission? To arm you with all the intel you need to not just survive but totally thrive in your new digs (and make smart choices about your health along the way).

![Understanding Healthcare Systems for Expats [2025 Update] Understanding Healthcare Systems for Expats [2025 Update]](https://kakiprod.com/wp-content/uploads/emplibot/expat-healthcare-1751591351-768x439.jpeg)