Deciding to move abroad—yeah, that’s a biggie. And yeah, you’ve gotta get a grip on the financial side of things. Enter Kaki Prod. They’ve gone deep into the weeds, breaking down the cost of living in those trendy expat hotspots, so you’re not flying blind here.

What have they got? A cost comparison that doesn’t just skim the surface. We’re talking housing, everyday expenses, the whole shebang, in places like Canada, USA, Australia, UAE, and Germany. It’s a full-on guide, arming you with all the intel you need to nail your international leap.

Where Do Expats Thrive Most?

Top Expat Destinations: A Global Overview

So, you want to be an expat? Fair enough-millions of people across the globe are making the big leap. Recent entries from InterNations show Canada, the USA, Australia, the UAE, and Germany are where it’s at for the globetrotting adventurers seeking fresh career paths and lifestyles. Nice lineup, right?

What Sets These Countries Apart?

Canada, it’s calling you with open arms thanks to all its welcoming policies and top-notch living standards. Heads up-more than 40% of 2025’s planned permanent resident admissions are current temps making it official. The USA? It’s an epic job market-it’s got everything and everyone. Nearly 49% of Americans abroad are chasing the ever-elusive work-life balance. Then there’s Australia, where laid-back meets economic juggernaut. The UAE rolls out the red carpet with tax-free cash and lavish lifestyles. Germany boasts a strong economy with healthcare that rivals the gods themselves.

But let’s talk wallets-living costs in these nations? They range from brutal to bearable. Dubai might squeeze your bank account, while some German cities offer high living standards without bleeding you dry.

Key Factors Shaping Living Costs

Alright, here’s what really drains an expat’s bank account:

- Housing: Living costs are in the killer category. If you’re aiming for Vancouver, San Francisco, or Sydney, brace yourself-housing will cost you a pretty penny.

- Healthcare: Varies hugely. Canada and Australia have you covered with universal healthcare. The USA? Well, brace for medical bill shock.

- Transportation: Public vs. private is a biggie. Especially in places like Singapore, where owning a car might cost you an organ or two.

- Food and groceries: Locally grown or imported-this impacts your daily costs significantly.

- Taxes: Wide-ranging. UAE gives a welcome tax break, while Germany collects more but gives great benefits back.

The Importance of Cost Comparison

Dig into these details before boarding that plane. Big salary offers look shiny, but factor in costs, and suddenly, the grass may not be so green. Consider this: you earn $100K in San Fran-but due to house prices, it might have less mileage than $70K in Austin. And those irresistible Dubai salaries? Rent and schooling might eat away at that income. Living in Dubai costs an individual around USD $1,975 monthly, with families at about USD $4,546.

Kaki Prod’s wise words? Research like Sherlock. Compare, contrast, then decide. Living costs are just a slice of the pie. Career growth, work-life balance, cultural vibes-they make or break expatriate success.

Next up: diving into the nitty-gritty of housing costs across these hotspots. Decoding rental rates, property buys, and hidden expenses will give a clearer snapshot of what’s coming your way. Stay tuned!

What’s the Real Cost of Housing for Expats?

Renting in Major Cities: A Mixed Bag

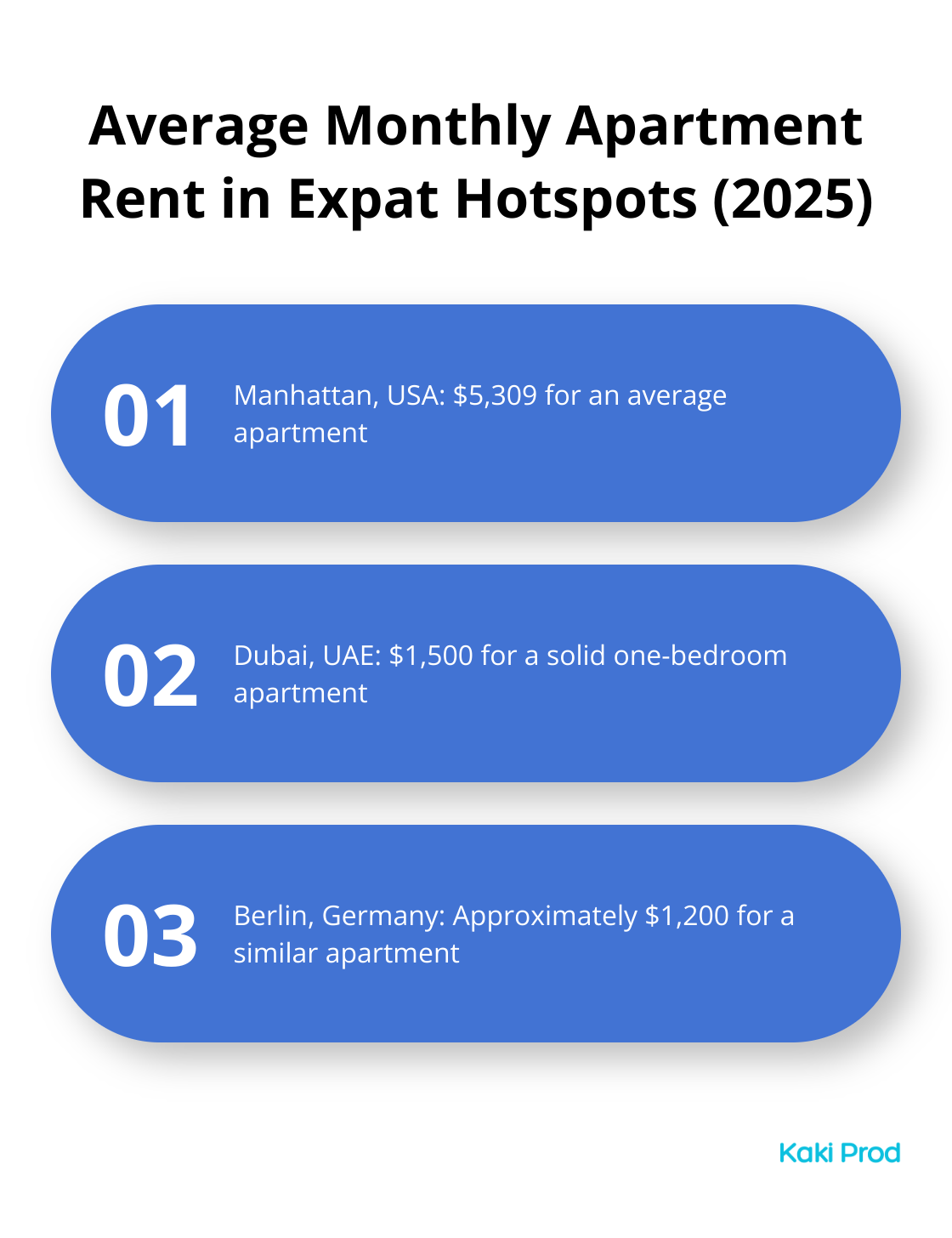

So, housing-it’s the beast that eats up a lion’s share of an expat’s budget. Fast forward to 2025, and the story is the same, yet different. Prices vary wildly across popular expat hubs. Let’s talk cold, hard cash-The average apartment rent in Manhattan? You’re looking at $5,309 each month. But hey, Berlin’s waving from the affordability camp at roughly $1,200 for similar digs. And then there’s Dubai, chilling right in between with a $1,500 price tag for a solid one-bedroom spot.

Now, if you’re a sharp expat, there’s room to maneuver-venture a bit beyond city centers. Take Toronto: say yes to a longer commute (20 minutes) and slash your rent by up to 30%. In Sydney? Swap the CBD for Parramatta and pocket $500 each month (a nice chunk for those watching their wallets).

Property Purchase: Long-Term Investment Considerations

Consider playing the long game and buying property? Gear up-it’s not a small pile of coins you’re committing to. In Vancouver, homes aren’t going for peanuts… $1.2 million will typically seal the deal in 2025. Melbourne trails closely at $950,000. But look further afield, and wallets sigh with relief. Lisbon’s got city-center apartments around $350,000. Not bad, right?

But hold your horses-scope out the local rulebook first. Some countries are stingy about foreign hands on land deeds. Like Thailand, where foreigners and land ownership? Not happening. (Always-yes, always-huddle up with local real estate savvy folks before jumping in.)

Hidden Costs: Utilities and Maintenance

Hidden curveballs-that’s what these ongoing expenses are. Newbies get blindsided here. Germany, for instance, hands you a $200 monthly utility bill, while the UAE’s battle with heat cranks it up to $300+. And when it comes to older European cities, brace for maintenance to pop financial surprises.

One Paris expat said an extra 15% of rent disappears annually into repairs. Compare that to Singapore’s subsidized housing (HDBs), where maintenance gets bundled into the cost-predictable, thank you very much.

Location-Specific Considerations

Each city’s like a puzzle with unique challenges and perks for expat housing. Tokyo? ‘Key money’-a cool term for a non-refundable landlord gift-can make renting pricier from the start. Meanwhile, in Amsterdam, there’s a real hustle going down; housing shortages make for a dog-eat-dog market and waiting lists aplenty for those prime spots.

Think about the show local regulations put on. Berlin rolls out rent control, which is great for sticking around long-term but might shrink housing options. Vancouver strikes differently, slapping foreign buyer taxes on the map, playing with expats’ property-buying plans.

Before diving into daily living expenses, crystal clear-housing costs? They lay the groundwork for an expat’s financial journey. Knowing these numbers in your next town is Step One for nailing a successful move.

What Does Daily Life Cost Expats?

Food Expenses: A Global Comparison

Expats encounter a smorgasbord of food costs across hotspots worldwide. So, this nifty tool? It dishes out a full course of data, helping you sift through the dollars and sense of living in foreign lands.

Eating out? That’s where things get spicy. NYC serves up a basic meal for a cool $20-$30, while in Berlin, you can munch similarly for just half the cash. Hop over to Bangkok, and $5 gets you street food nirvana-tasty and authentic.

Transportation: Moving Without Overspending

Transport-your passport to local life-varies wherever you hang your hat. London’s travel card will lighten your wallet by about £150 ($190) each month, but in Prague, you’re cruising with a similar pass for just €20 ($22).

Got legs or wheels? Cities like Amsterdam and Copenhagen are a cyclist’s dream, letting expats pedal past the pocket-draining trap of public transport. Many European cities? They’re all about those bike-sharing programs and bike lanes. Meanwhile, Singapore’s MRT system is a win-win for both efficiency and affordability, with monthly travel in the $90 ballpark.

Healthcare: The Price of Wellbeing

Dollars or dirhams, healthcare bills come in all flavors. But here’s the kicker: the top contenders treat expats to consistent and wallet-friendly healthcare, public and private-style.

In sunny Australia? Once you’re through a waiting spell, Medicare’s in your corner. But a chunk of expats opt for private insurance-$150-$200 a month keeps those bases covered. The UAE mandates employer-provided insurance, but it can be the bare bones. So for peace of mind, add $1,000-$2,000 to your annual health budget.

Entertainment and Leisure: Fun on a Budget

A blast without busting the piggy bank? Absolutely. Berlin’s museums woo you with free entries on first-of-the-month Sundays. Tokyo-parks, and gardens are your gratis glimpse into local life’s nitty-gritty, easing the sting of spendy nightlife.

Fancy a flick in Dubai? $12 lets you in on the silver screen action, but bargain hunters should aim for Bangkok’s $5 tickets. Gym buffs? Pump iron for as little as $20 monthly in Southeast Asia, while stateside cities can stretch that budget to a steep $100+.

Adapting to Local Costs

Numbers bouncing off the charts? Yeah, they’re averages and bound to sway with lifestyle whims and locale quirks. Expats looking to keep finances neat should dive deep into research, sync with local rhythms, and snag deals like a pro. (Your bank account? It’ll high-five you for the hustle.)

Final Thoughts

So, here’s the deal – moving abroad…it’s a wild ride. And you’ve got to get your calculator out for the cost comparison extravaganza. We’re talking housing expenses, healthcare costs, and those day-to-day expenses that sneak up on you like a cat in the night. Oh, and by the way, don’t forget to throw career opportunities and lifestyle dreams into the mix. Enter Kaki Prod – your co-pilot in this international adventure.

These folks have visa guides, career advice, cultural insights – basically, they’re the Swiss Army knife of expat resources. Armed with their intel, you can make smart, savvy decisions about where to hang your hat abroad. Their mission? To have your back as you take this leap into the unknown – a brand new chapter of awesomeness.

Here’s the sweet spot: a destination that nails the cost-opportunity equation. With some solid homework and reliable support, you’ll pick the perfect place for you. Get ready to dive into your international journey – it’s a playground of new experiences and personal growth. You’re about to level up, big time.