At Kaki Prod, we’re all about that financial freedom — yes, it’s within everyone’s reach. Passive income? It’s the golden ticket, the secret sauce… the thing that lets you make money while catching Z’s. In this post, we’re diving deep into the world of passive income streams and strategies (sounds fancy, right?) to help you stack up that wealth over time.

What Is Passive Income?

Defining Passive Income

So, passive income-guess what? It’s like getting paid to do nothing. Almost. It’s earning that barely lifts a finger after the initial grunt work is done. Unlike clock-watching at your 9-to-5, this flows to you as you sleep, globe-trot, or binge-watch Netflix. Sweet deal, right?

The Impact of Passive Income

Now, here’s a nugget from Bankrate: apparently, 61% of workers snagged a pay raise post-October 2023. That’s a nudge down from 64% and holding steady from 2022. But hey, while this isn’t waving the passive income flag, it screams something-you gotta diversify how you stack your cash.

Active vs. Passive Income: Key Differences

Active income? That’s trading hours for dollars. You log your time, you cash your check. But passive income? You hustle upfront-a bit-but then it’s ka-ching! For instance:

- Active Income: A Canadian software coder’s paycheck

- Passive Income: Dollars pouring from an online coding course-day in, day out

Financial Freedom Through Passive Income

Here’s the biggie-passive income is the golden ticket to financial freedom. It’s how you:

- Stockpile an emergency fund (a lifesaver for expats on foreign soil)

- Bulldoze debt faster (relocation loans, anyone?)

- Max out investments (strategizing for that wealth marathon)

- Ponder early retirement or a cushy part-time gig

And behold, a Federal Reserve study notes that variations in net worth across different groups mirror those in income, but the disparity is wider. Bottom line? Households with extra income streams, like passive income, may boost their net worth significantly.

Passive Income for Expats and Immigrants

Many expats and immigrants are tuning into the power of passive income to fund their overseas exploits and stabilize their cash landscape in new lands. Through real estate plays, dividend stocks, or venturing into online businesses, passive income lays the groundwork for thriving abroad.

As we dive into sought-after passive income streams next, you’ll uncover ways to kickstart your own money machines-wherever on this planet you plant your flag. These tactics can ease your landing in foreign territory and chart a course toward lasting financial triumph.

Top Passive Income Streams

Real Estate: A Solid Foundation

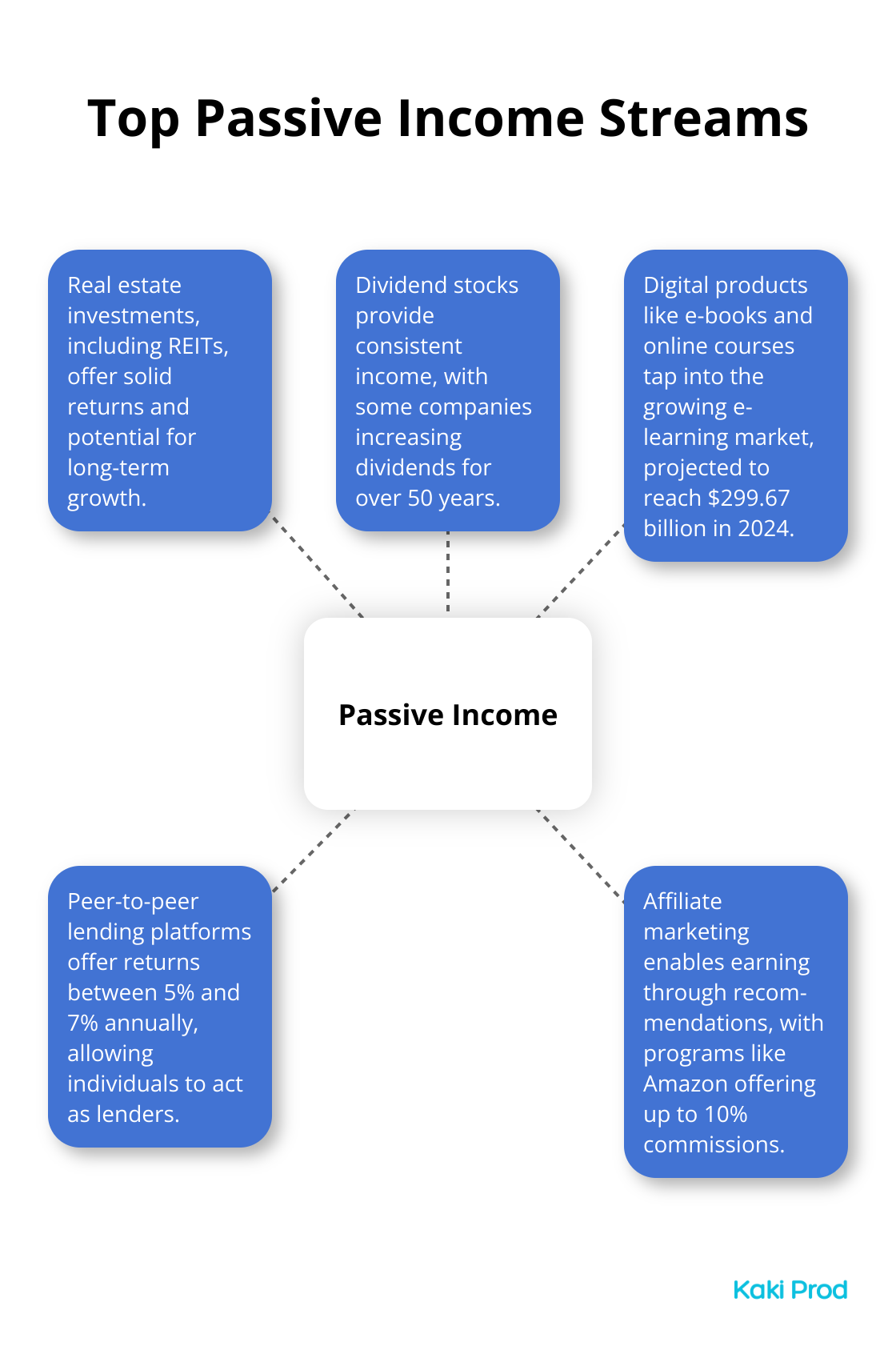

Real estate-it’s the OG of passive income. According to the National Association of Realtors, single-family homes in the U.S. pulled in a median rental income of $2,000 per month in 2024. You savvy investor types, listen up: You don’t have to buy the whole house. Dive into Real Estate Investment Trusts (REITs) and skip the landlord headaches. Take Iron Mountain Inc (IRM) for instance; if you’d thrown in $10,000 a decade ago, you’d be sitting on over $60,000 right now. Boom.

Dividend Stocks: Consistent Income

Dividend stocks-your steady Eddy income stream. The S&P 500 Dividend Aristocrats are like that friend who’s always there (you know the one). They’ve outpaced the S&P 500, with less rollercoaster drama, boasting better risk-adjusted returns. The legends like Johnson & Johnson or Procter & Gamble? They’ve been cranking up dividends for over half a century. Reliable? Oh yeah, like clockwork.

Digital Products: Monetize Your Expertise

Now, digital products-talk about the modern money machine. The global e-learning market? A cool USD 299.67 billion in 2024, projected to grow by 19.0% annually from 2025 to 2030. E-books, online courses, software…take your know-how and toss it into the internet’s ongoing money printer. Courses on platforms like Udemy can pocket you an average of $5,000 a year-top creators hit those sweet six figures. Jealous? Don’t be-just start creating.

Peer-to-Peer Lending: Be the Bank

Forget your childhood lemonade stand-peer-to-peer lending lets you play bank. Whether on Prosper or LendingClub, expect returns between 5% and 7% annually-your risk appetite, your call. Spread your cash across multiple loans and watch risk stand down. Voilà-you’re essentially lending out cash and raking in interest like it’s nothing.

Affiliate Marketing: Earn Through Recommendations

Affiliate marketing? You’re basically getting paid for recommendations (like when you told everyone about that Netflix series-and now you could get paid). Amazon’s affiliate program doles out up to 10% commissions on qualifying purchases. Successful bloggers and content creators? They’re raking it in through savvy affiliate partnerships. Knock, knock-opportunity calling.

Passive income needs front-loaded effort and some ongoing TLC, but…the payoff? Financial freedom on your terms. The next section dives into strategies to supercharge these income streams-tailored just for you, fitting neatly with your goals. Let’s get that bread.

How to Build Passive Income Streams

Leverage Your Expertise

At Kaki Prod, we’ve seen the magic trick of expats and immigrants turning their financial destinies around with passive income. Here’s your no-nonsense playbook to dive in.

First move – audit your talents. Got spreadsheet skills? Whip up some killer templates and throw them up on Etsy. According to their 2023 financials, sellers pocketed a whopping $13.3 billion. Not too shabby for digital dabblers.

Speak multiple languages? That’s your ace in the hole. The language learning app industry is blazing toward a $21.2 billion jackpot by 2027 (Mordor Intelligence said it, not me). Craft your language learning content and ride that wave.

Start Small, Think Big

Don’t let those tight wallet strings hold you back. Start with your current arsenal. Platforms like Teachable are ready and willing to let you roll out online courses with zero upfront cash. And their top-notch creators? Pulling in over $100,000 a year.

Got a little stash? Dividend stocks are calling your name. Check out SPDR S&P Dividend ETF (SDY) which rocked a 3-Year Return of 4.73%. It’s the lazy way to let your wealth stretch its legs over time.

Diversify Your Portfolio

Mix it like a pro – add some spice with high-risk hotshots and ground it with steady stallions. Think growth stocks and rental properties, or affiliate marketing with a dash of peer-to-peer lending.

Platforms like Prosper reported a cool 5.5% average return in 2023. It’s not a get-rich-quick ticket, but a smart addition to your diversified treasure chest.

Automate Your Processes

Time is cash, folks, especially when you’re molding passive income streams. Tools like IFTTT or Zapier are your digital minions for automating the grind – from social media blasts to email buzz.

Real estate magicians, lend me your ears: Property management software like Buildium does the heavy lifting for rent collection and pesky maintenance chores. It’s like magic for landlords juggling a circus of properties.

Truly passive cash flow? That’s the unicorn we all dream of. Most streams demand a bit of elbow grease. Yet with savvy strategies and the right gizmos, you can trim that workout while beefing up your returns.

Final Thoughts

Passive income – it’s the golden ticket. Turns that financial freedom fantasy into, well, your everyday reality. We’ve taken a jaunt through various methods – each a unique little treasure chest brimming with the potential to build wealth over time. Sure, these setups require some initial elbow grease and ongoing tinkering, but that long-term payoff? Totally worth the sweat.

What’s the beauty of passive income? Flexibility. It’s your playground. Start tiny, grow big. You can dive in right now just by figuring out your skills, hobbies, and what you’ve got to work with. Take that leap into crafting your own passive income kingdom (because, let’s be real, every big shot millionaire kicked off somewhere small).

And hey, at Kaki Prod, we’re cheering for you along the way to financial independence. Our platform? It’s stuffed with resources on personal growth, climbing the career ladder, and pumping up your financial chops. Swing by EverydayNext for more brain fuel and tools to boost your passive income adventures and personal growth journey.